Policy Survey 2024: ESG Issues

This post provides an overview of a section of Glass Lewis’ 2024 Policy Survey, conducted to inform their annual “benchmark” policy guideline updates.

Voting on Non-Financial Reporting

In Spain and Switzerland, companies are now required to prepare a report on non-financial matters (i.e., environmental, social, and employment-related matters, respect for human rights, and anti-corruption) on an annual basis, and submit that reporting to a shareholder vote.

Across the board, investors were more likely to consider voting against, with expectations particularly higher regarding the timeliness, completeness and/or quality of reporting.

“If the non-financial report fails to align with globally recognized reporting standards and frameworks, like the TCFD and GRI, a vote against may be warranted. If the report doesn’t adequately disclose the company’s relevant impact areas, dependencies and risks, and how these issues impact its long term strategy, a vote against is also warranted.” (European investor)

“This would need to be applied in a case of extremes. But if one company only provides high-level, boilerplate statements with respect to its ESG policies and initiatives without any meaningful data to assess performance — whereas peers are all much more developed — then that report should not be supported.” (Global investor)

“Specifically on reporting, when the company does not report conform widely adopted market esg reporting standards, for example a company with material climate risk exposure does not report according tcfd or cdp standards” (U.S. investor)

Many non-investors offered a different view:

“ESG should be an area for engagement” (Canadian non-investor)

“Let’s apply the same logic as for the financial reporting: shareholders do not vote against a financial reporting because the performance is poor!” (European non-investor)

There appear to be different approaches to non-financial reporting based on geography. Whereas 12% of North American investors would never consider voting against a company’s non-financial reporting under any circumstances, no investors from other markets provided this response. There was a similar gap between non-investors, 30.9% for North Americans and 10.2% for other markets.

B-Corporations

Adopting a B Corporation structure certifies that a business is meeting high standards of verified performance, accountability, and transparency on factors from employee benefits and charitable giving to supply chain practices and input materials.

Among both investors and non-investors, the most popular response was that adopting a B corporation form is unnecessary, as companies are already able to consider stakeholders and environmental factors; however, this only accounted for roughly four in ten investors, vs a majority of non-investors. Investors were more likely to respond that boards should take whatever corporate form they deem appropriate (32.4% vs 14.5% among noninvestors). There was a notable geographic split among investors, with respondents from outside North America more likely to be open to the B corp form (66.7%, vs 46.3% among North American investors).

Sustainability Audits

A majority of both investors and non-investors either find it reasonable for all companies to retain the same external audit firm to provide both financial and sustainability assurance, or don’t think it matters (58.3% of investors, vs 54.4% of non-investors).

Investors were nearly three times more likely to view it as acceptable for a transition period, but generally prefer separate auditors (29.2%, vs 10.6% among non-investors).

Climate Transition

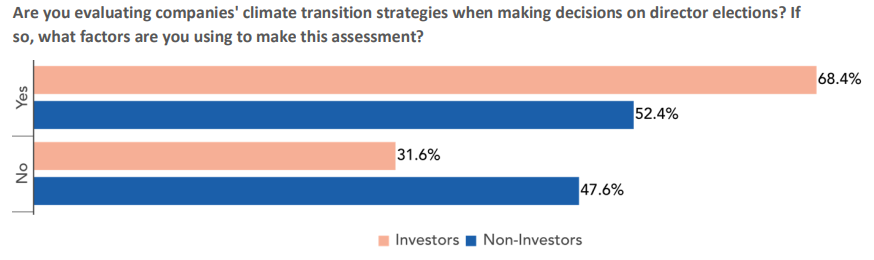

Of the minority of investor respondents who do not currently evaluate climate transition strategies when making decisions on director elections, roughly a quarter indicated that they plan to begin doing so in future. Among those that answered “Yes”, there were a range of approaches. Some look at the overall quality and robustness of the company’s climate strategy and reporting, but many cited more specific factors (see below).

Several commented that they only apply climate transition considerations to director voting at certain companies, assessed either sector-by-sector, based on the Climate Action 100 list, or on an ad hoc basis. Another consideration is engagement; many investors stated that they only turn to director voting if the company has not been responsive to discussions on the topic. For example:

“Yes, dependent on sector and engagement strategy. We will escalate votes against directors for climate reasons if the company is in a high-emitting sector and/or as a next step in an engagement plan for the company.” (Canadian investor)

“Yes. Materiality of the risk is first (whether or not they are CA100+ list names), and then the robustness of the proposed approach given that materiality” (European investor)

Some were more specific about their voting policies.

“For CO2 intensive companies, we vote against the chairman of the E&S (responsible) committee if the company does not have SBTi certified emission reduction targets. Alternatively, if there is no E&S (responsible) committee, we vote against the chairman of the Board.” (European investor)

“We will vote against the entire board of directors if they have not disclosed scope 1 and scope 2 emissions or if they do not have a climate report aligned with TCFD recommendations/or meet requirements of IFRS S2. For high emitting companies (for example, companies in CA100+) we also expect them to have established GHG emissions reductions goals or we will vote against the entire board. We make exceptions for directors with less than 1 year tenure” (U.S. investor)

While there were substantially fewer responses from non-investors on this proxy voting-centric question, some did share their comments. For example, a U.S. non-investor opined that:

“Director votes should focus on the Directors’ expertise to oversee climate transition strategies and related risks and opportunities.”

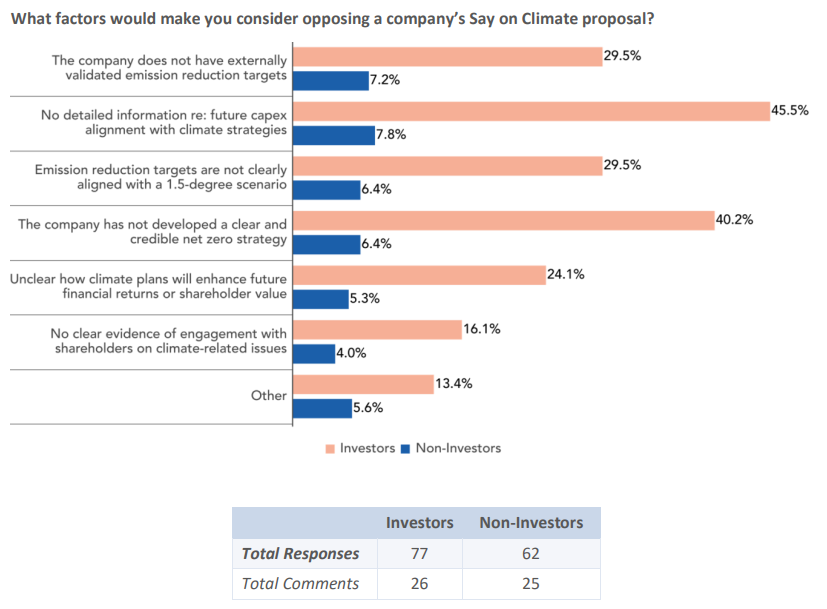

Say on Climate Voting

There was a notable geographic split on investors’ approach to Say on Climate. While a slightly greater proportion of North American investors would consider voting against a proposal where the link to financial and shareholder returns is unclear, for all other factors, investors from other markets were more likely to consider voting against, in some cases by a wide margin. In particular, alignment of capital expenditures with long-term climate strategy, alignment with a 1.5-degree scenario, and the presence of a net zero strategy were all seen as significantly more important by non-North American investors.

“Our voting on Say on Climate proposals is based on company plans meeting our core climate change expectations and our further guidance on transition plans. In the former we look for: board oversight of climate risks and opportunites, climate risk disclosures, greenhouse gas reporting, net zero and interim targets and transition plans. On transition plans specifically we look for time-bound and quantified decarbonisation strategies, including the specific abatement measures needed to reach their interim emission reduction targets, including internal abatement measures, divestments, output changes, carbon credits and contractual instruments such as RECs.” (European investor)

“[I]f the company’s climate strategy doesn’t adequately address the material climate-related risks the company faces.” (UK investor)

“A lack of engagement with net zero goals would also increase our expectations around scenario analysis (i.e. business reliance assessment) and disclosure of physical climate risk planning. We would consider voting against if this is not present and our evaluation of Say on Climate proposals are highly influenced by the energy intensity of the company’s activities.” (U.S. investor)

“The company has recently stepped back from their initial targets without providing sufficient rationale for such a change in direction” (U.S. investor)

Notably, respondents from both segments raised concerns with the use of Say on Climate votes:

“It is our expectation that management have a climate strategy that is approved by the Board and that details are provided to shareholders. However, an advisory vote on climate is not ideal in our view and if a company does not meet our expectations on its approach to climate change, we will vote against the election of directors.” (U.S. investor)

“The Fund does not find Say on Climate proposals to be beneficial to shareholders.” (U.S. investor)

“SoC is unrelated to real action or progress on emissions and should not be a vehicle for use in proxy statements.” (U.S. non-investor)

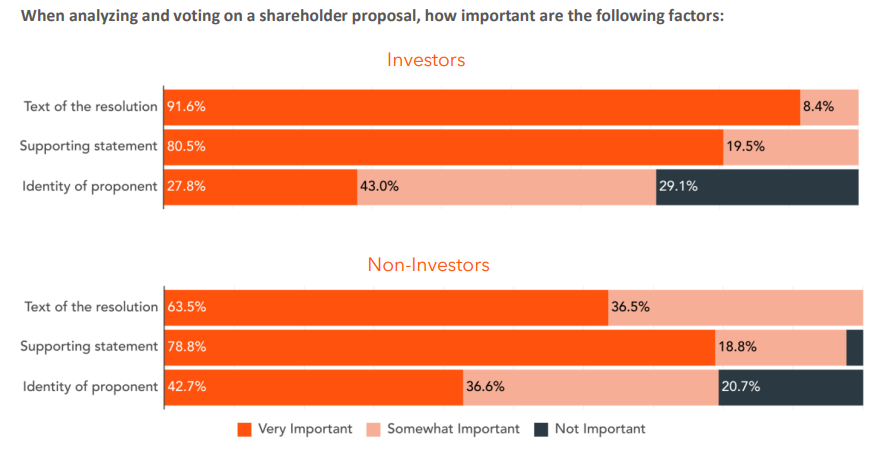

Approach to Shareholder Proposals

How respondents approach shareholder proposals were generally aligned across different segments, with all or a significant majority viewing each component as “Very” or “Somewhat Important”. Of the three components we asked about, proponent identity was the most divisive, but was nonetheless viewed as “Very” or “Somewhat Important” by over 70% of investors. Notably, more North American investors view the identity of the proponent as “Not Important” (37.0%, vs 18.2% for other markets).

Despite the broad alignment, investors expressed a range of views on how to approach shareholder proposals:

“The text of the resolution and supporting statement are important in that they can make a compelling case as to why a certain action builds long term shareholder value. BUT we cannot forget that these proposals are non-binding. Support for a less-than-perfectly-worded climate-related proposal still warrants support at a company with lagging climate ambition/performance. Instead of furrowing our brows over how reasonable an ask is, we should see the forest for the trees.” (Global investor)

“Many anti ESG proposals lately so having identity of the proponent is important. We currently don’t vote in spirit of proposals and read them to the letter, so the text and the supporting statement are important.” (U.S. investor)

Some investors noted other considerations:

“Another important piece of information is the success of a proposal in previous years, as well as a company’s response and any actions taken, if it has been tabled at prior company AGMs.” (Canadian investor)

We followed up on how the proponent’s identity is considered, and found that far fewer investors view the number of shares held as “Very” or “Somewhat Important” (50%, vs 78.5% of non-investors).

Link to the full report can be found here.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release