2025 Proxy Season Preview

Shareholder proposals reached record levels in 2024, signaling continued shareholder engagement pressures for 2025. Companies should continue proactively engaging with shareholders, monitor policy updates, and ensure compliance with regulatory requirements to navigate this dynamic landscape effectively.

Key Insights

Shareholder Proposals

Overall

The 2024 proxy season witnessed a record number of shareholder activism campaigns, with the total number of campaigns nearly doubling to 411 in the Russell 3000 from 206 in 2021; however, success rates for activists dropped significantly, from 56% in 2023 to 38% in 2024 (compared to 37.5% in 2022 and 57% in 2021). These trends are likely to continue in 2025. Considering this, companies should continue to prepare for heightened shareholder engagement and potential challenges to their strategic and operational decisions, which activist investors have been increasingly prioritizing over mergers and acquisitions.

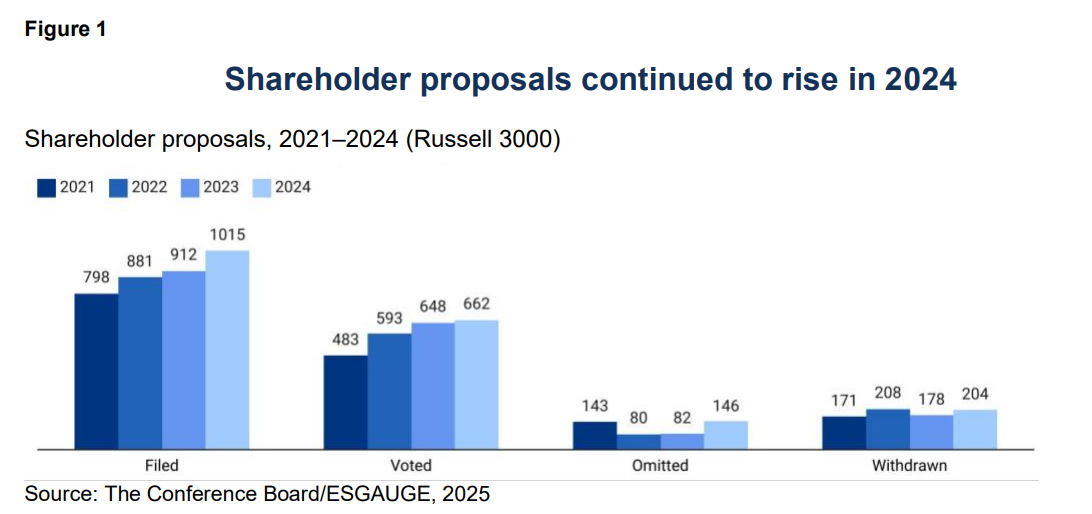

The volume of shareholder proposals continued to increase year-over-year, reaching a record 1,015 proposals filed in 2024 in the Russell 3000, a 27% rise since 2021. Meanwhile, voted proposals increased from 648 to 662 over the same period. A few companies expect a decline in shareholder proposals this year, which they attribute to effective shareholder outreach programs and, for some, improved stock performance. Some pro-ESG proponents may also be focusing on quality versus quantity, filing less prescriptive proposals that are more likely to garner support. Nevertheless, it is expected that the volume of anti-ESG proposals will continue to increase steadily as the topic remains highly politicized.

However, on February 12, 2025, the Securities and Exchange Commission’s (SEC) Division of Corporation Finance issued Staff Legal Bulletin No.14M (SLB 14M), broadening the ability of companies to exclude shareholder proposals—including both pro- and anti-ESG proposals— based on “economic significance” and “ordinary business.” The bulletin rescinded Staff Legal Bulletin No.14L (SLB 14L) and reinstated prior guidance. The rescission of SLB 14L and the reinstatement of prior guidance reflect a shift in the SEC’s approach to shareholder proposals, emphasizing the importance of allowing companies to manage ordinary business operations without undue interference from proposals that may not be economically significant to the company’s core business. The full impact of SLB 14M may be more pronounced in the 2026 proxy season but we could still expect to see immediate effects in how companies and investors navigate proposal challenges this year.

Average support for shareholder proposals peaked at 35% in 2021 and steadily declined through 2024 (23%). An exception was governance proposals, which were back to 2021 levels (39%), up from 30% in 2023. The average support for shareholder proposals during the first two months of 2025 is 20%. This is slightly higher than what it was in 2024 during the same period (15%) but lower than in 2023 (23%), with five out of 21 proposals passing. The five proposals that passed in early 2025 focused on non-contentious governance matters (i.e., director elections and bylaw amendments). The 16 proposals that failed focus on a mix of corporate governance, environmental, and social proposals, including an anti-ESG diversity, equity & inclusion (DEI) proposal filed by the National Center for Public Policy Research at Costco (see DEI at Costco, page 8).

|

Combating Proposal Fatigue

Companies and institutional investors have reported “proposal fatigue,” not only from the quantity but also from the deteriorating quality of proposals filed. Both pro- and anti-ESG proposals—particularly on environmental, social, and human capital management topics—have been overly prescriptive and, as a result, experienced waning support over the last few years. Many pro-ESG proposals have been criticized for leaving little room for board and management discretion, demanding detailed actions, timelines, or disclosure requirements without considering operational complexities and costs. Some anti-ESG proposals have sought to reduce sustainability reporting or ban certain ESG-related initiatives entirely, which many companies and institutional investors have viewed as overly restrictive and potentially detrimental to long-term financial performance. Companies have also made substantial improvements in ESG disclosures and data transparency, so investors generally do not feel the need to support shareholder proposals requesting minor, overly prescriptive adjustments. Continuing to provide detailed information in the proxy statement on the costs, unintended consequences, and limited benefits of implementing shareholder proposals will benefit both companies and investors needing to justify their positions when casting their votes. |

Some companies are finding it increasingly challenging to navigate competing stances on ESG issues amid a growing mix of both pro- and anti-ESG proposals, with anti-ESG proponents becoming more assertive in recent years. In the S&P 500, 25% of shareholder proposals (14 out of 57) filed as of February 2025 (including omitted and withdrawn) have come from antiESG groups, up from 21% during the same period in 2024. It is worth noting that anti-ESG groups often file their proposals early in the season to gain media attention and secure prominent placement on meeting agendas. Despite this early activity, the overall share of antiESG proposals for all of 2024 remained at 13%, consistent with 2023 levels. [1]

During a recent pre-proxy season discussion, several companies indicated that emerging topics such as AI are often discussed during company engagements before proposals are formally filed, providing companies with an opportunity to address concerns that could have otherwise been raised through shareholder proposals. They also reported a divergence in investor priorities based on geographic location, notably the EU versus the US. In the EU, investors tend to prioritize climate action, stringent sustainability disclosures, and human rights due diligence, aligning with regulatory frameworks such as the Corporate Sustainability Reporting Directive (CSRD) and the EU Green Deal. In contrast, US investors focus more on financial materiality, board oversight of ESG risks, and concerns over regulatory overreach, with increasing skepticism toward prescriptive ESG mandates.

Key themes in the proposals filed as of February 2025 include both pro- and anti-DEI requests, specifically calling for the elimination of DEI programs or targeting companies that have already scaled back on their DEI efforts. This sustained scrutiny on corporate DEI is likely to intensify in light of the overturning of Nasdaq’s board diversity listing standards and the new administration’s executive orders and directives targeting DEI initiatives beyond government agencies.

Governance proposals

Although more governance proposals were filed in 2024, fewer were brought to a vote compared to 2023. However, the proposals that did go to a vote were, on average, significantly more successful. We can expect a similar trend this year, with average support of governance proposals increasing as environmental and social proposals become less topical.

As of February 2025, the primary focus of governance proposals includes requests for director election resignation bylaw provisions; 10 such proposals have been filed, eight of which went to a vote and failed. Other topics include requests for annual director elections (three proposals filed by the same proponent) and requests for separate CEO/Chair positions (two proposals filed, with one withdrawn). Meanwhile, 11 out of 31 (35%) governance and executive compensation proposals filed in early 2025 have already been either withdrawn or omitted.

As the political landscape and improvements in existing disclosures cause investors to shift their focus away from E&S issues, core governance topics such as executive compensation might face more scrutiny this proxy season—particularly as updated proxy voting guidelines emphasize a case-by-case evaluation approach. Companies should continue engaging with investors and proxy advisors, particularly if there is a risk for potential pay-for-performance misalignment, uncommon practices, or unclear disclosures.

Environmental and social proposals

The number of environmental and climate-related proposals filed stagnated between 2023 and 2024 but shareholder support dropped slightly. Some companies attribute this to evolving political and regulatory contexts—particularly as impending mandatory sustainability disclosure requirements (i.e., the CSRD in Europe) improve company disclosures and prompt some shareholders to adopt a “wait-and-see” approach to upcoming disclosures. Indeed, investors may feel less urgency to push for additional transparency or policy changes as more companies are already providing or are expected to provide detailed E&S reporting.

While E&S issues remain important to investors, some are reassessing their approach to related topics due to growing concerns over ESG backlash and increasing scrutiny surrounding ESG investing. Only one climate-related proposal was filed in early 2025: a request for an annual emissions congruency report at Starbucks. [2]

Average support for climate-related proposals remained subdued in 2024, even when excluding anti-ESG filers. Institutional investors such as BlackRock said the majority of proposals “were over reaching, lacked economic merit, or sought outcomes that were unlikely to promote longterm shareholder value.” In 2024 only 2% of climate and natural capital proposals and 4% of all environmental and social proposals received support from the asset manager, down from 6.7% in 2023 and 47% in 2021. Similarly, Vanguard did not support any of the 400 E&S proposals reviewed in 2024, noting that the proposals “did not address financially material risks to shareholders at the companies in question or were overly prescriptive in their requests— including, for example, proposals calling for specific greenhouse gas (GHG) emissions targets or third-party audits of aspects of portfolio company operations.”

With increasing investor focus on topics like AI, companies should be prepared for greater scrutiny and review the effectiveness of their risk assessments related to AI use or development. One shareholder proposal related to AI was submitted in the Russell 3000 through February 2025; for comparison, there were 16 shareholder proposals filed in 2024 and one in 2023.

Human capital management proposals

Human capital management (HCM) has been an important focus area for shareholder proposals in recent years, reflecting ongoing debates over workforce policies, corporate diversity efforts, and regulatory scrutiny.

As of February, four out of eight human capital management shareholder proposals filed relate to diversity and inclusion, three of which were from anti-DEI filers. Anti-DEI proposals more than doubled from six in 2023 to 13 in 2024 amid increasing political and legal scrutiny on corporate DEI efforts, although support remained low at 1.7% in 2024. Companies surveyed noted a rise in anti-DEI lawsuits targeting investors and are struggling to navigate the balance between implementing DEI initiatives and addressing investor concerns about potential legal and financial risks.

| DEI at Costco

At Costco’s 2025 annual general meeting in January, the company’s shareholders voted down an anti-DEI proposal submitted by The National Center for Public Policy Research, [3] which requested Costco report on the risks of maintaining its DEI efforts. The organization cited a number of DEI-related lawsuits following the 2023 Supreme Court ruling in Students for Fair Admission v. Harvard that ended affirmative action in college admissions and claiming that DEI holds “litigation, reputational and financial risks to the company, and therefore financial risks to shareholders.” Costco’s board unanimously recommended shareholders vote against the proposal, arguing that the company’s “commitment to an enterprise rooted in respect and inclusion is appropriate and necessary.” The board said that the report requested by the proposal would not provide meaningful additional information to shareholders and would not be an efficient use of company resources. The proposal received only 1.7% shareholder support. Costco’s defense of its DEI initiatives comes at a time of intense scrutiny on corporate DEI efforts, with several major US corporations—such as Meta, Walmart, McDonald’s, and Ford—publicly revising their messaging around programs promoting workplace equality and inclusion. |

Management Proposals

Director elections

While average support for director elections continued to increase slightly in 2024, governance concerns such as board composition, overcommitment (overboarding), or compensation practices remained key drivers of targeted votes against directors, whom investors hold accountable for misalignment with best practices. To stay ahead of evolving expectations, companies should continue building strong governance frameworks aligned with best practices, maintain consistent and proactive engagement, and provide detailed disclosures on these efforts.

Committee chairs

Support for nomination/governance committee chairs remained the lowest compared to other committees, floating just below the 90% threshold, with 4.3% of directors receiving less than 70% support. This trend is mainly due to investors increasingly targeting this role (as well as the rest of the committee members) to signal concerns with companies’ governance practices, such as board composition, overboarding, independence, and CEO/board chair combination. During a pre-proxy season discussion, several corporate secretaries signaled that lower support was often due to challenges in diversity-related metrics. They acknowledged the importance of certain board composition requirements but found it difficult to balance overboarding issues, diversity requirements, skills gaps, and industry-specific talent shortages when searching for new board appointments.

Nomination/governance committees are expected to be busier than ever this year, facing heightened scrutiny on board composition and succession planning as investors push for directors with expertise in areas such as AI and sustainability. To meet these evolving demands, committees should continue to proactively refine their succession strategies by identifying emerging skills gaps and ensuring the board has the necessary expertise needed to navigate evolving business and technological landscapes, without forgoing broader board composition best practices.

While the average level of shareholder support for compensation committee chairs remained steady in 2024, investors continued to reduce support for compensation committee chairs when say-on-pay proposals failed, holding them accountable for perceived misalignment between executive pay programs and shareholder interests.

Executive compensation

Average support for say-on-pay slightly increased again in 2024, with more votes falling in the 70–90%+ range and reaching the lowest failure rate since 2017. Some companies attribute growing support to tailored engagement strategies, while also observing fewer engagement requests during strong stock performance years.

As economic conditions remain uncertain amid inflation, market volatility, and evolving labor dynamics, investors will want to ensure that pay outcomes are justified, transparent, and aligned with performance. The 2025 proxy season will be the third year that companies are required to make pay-versus-performance disclosures under Item 402(v) of Regulation S-K. [4] With several years of pay-versus-performance data now available, investors are likely to intensify their scrutiny of executive compensation alignment with company performance.

The most common factors investors cited when voting against say-on-pay proposals include misalignment between pay and performance, problematic compensation practices, insufficiently rigorous performance goals, and shortcomings in shareholder outreach and disclosure. To avoid further votes against compensation committee members, companies receiving say-on-pay results below Institutional Shareholder Services (ISS) or Glass Lewis review thresholds (70– 80%) should consider improving disclosures about shareholder engagement efforts and detailing specific actions taken in response to feedback.

Traditionally, companies primarily disclosed shareholder engagement in the Compensation Discussion and Analysis in response to unfavorable say-on-pay results. However, as shareholder engagement becomes a routine aspect of the executive compensation cycle—even in years without a failed vote or notable opposition—it is helpful to include a brief standing disclosure for stakeholders outlining the company’s general shareholder engagement policy.

Regular engagement is mutually beneficial to companies and shareholders beyond building rapport: it allows shareholders to familiarize themselves with companies’ policies and practices, while providing companies with insight into shareholder priorities. Established relationships may strengthen a company’s credibility with investors, particularly if and when they need to justify practices that might deviate from existing policies.

Other Topics and Trends

Proxy voting

For the 2025 proxy season, updates to proxy voting guidelines from ISS, Glass Lewis, BlackRock, and Vanguard are modest but share several common themes, reflecting broader trends in board oversight and composition, and shareholder engagement. Companies should familiarize themselves with these updates and consider whether changes to their practices or disclosures are needed to ensure alignment with expectations.

2025 US Proxy Voting Guidelines UpdatesBoard composition, accountability, and oversight Executive compensation Case-by-case evaluations |

The shift toward case-by-case approaches could drive more thoughtful, context-specific voting. This will likely raise the bar for ESG proposals but might also lead to inconsistencies in voting outcomes as investors attempt to balance competing pro- and anti-ESG sentiments within their client base. Companies will need to provide robust disclosures, demonstrate material relevance, and proactively engage with investors to navigate this evolving landscape effectively.

Pass-through voting

In the past few years, major institutional investors such as BlackRock, Vanguard, and State Street Global Advisors introduced pass-through voting programs, allowing certain clients the opportunity to indicate their voting preferences rather than relying on the asset manager to make all proxy voting decisions on their behalf.

While these programs have been expanded and refined, the adoption of pass-through voting has yet to gain sufficient traction to meaningfully impact voting outcomes or engagement strategies. Vanguard revealed that out of 2 million eligible investors in 2024, only about 40,000 participated in their pass-through program. Of these, 43% opted to follow Vanguard’s voting decisions and 30% aligned with company board recommendations. Similarly at BlackRock, of $2.8 trillion in assets eligible for Voting Choice (of $5.7 trillion total index equity), only $646 billion committed to exercising that option.

Although pass-through voting is still in its early stages, it has the potential to democratize shareholder engagement and increase the influence of proxy advisory firms as their voting policies are provided to eligible clients. Both investors and companies should prepare for its gradual adoption and impact on voting patterns.

This article is based on corporate disclosure data from The Conference Board Benchmarking platform, powered by ESGAUGE

1 As of February 18, 2025, a total of 73 shareholder proposals have been submitted within the Russell 3000, with 14 originating from anti-ESG groups. The majority of these proposals focus on corporate governance (28), followed by social issues (17) and human capital management (eight). The IT sector has been the primary target, receiving 15 proposals—six of which are directed at Apple, including one on AI data acquisition and usage filed by the National Legal and Policy Center. Other notable companies facing shareholder scrutiny include Walt Disney and Starbucks, with five proposals each; and Visa, with four proposals that already failed. (go back)

2 The National Center for Public Policy Research is a nonpartisan, free-market, independent conservative think tank whose mission is “to grow the freedom movement by taking our message to new constituencies to secure liberty now and for future generations.” The center’s Free Enterprise Project (FEP) engages in a variety of activities relating to corporate governance, including filing shareholder resolutions, to “push corporations to respect their fiduciary obligations and to stay out of political and social engineering.” So far this year, the FEP filed six proposals including an anti-DEI resolution at Costco and a climate-related resolution at Starbucks criticizing the CEO’s use of a private jet for his commute despite the company’s efforts to reduce greenhouse gas emissions. (go back)

3 See endnote above. (go back)

4 Item 402 of Regulation S-K requires public companies to disclose comprehensive information about the compensation of their top executives and directors, including salary, bonuses, stock options, and other benefits. This disclosure, presented in proxy statements and annual reports, ensures transparency for investors by detailing compensation policies, performance metrics, and potential conflicts of interest. The 2025 proxy season marks the third year that companies are required to provide pay-versus-performance disclosure under Item 402(v) of Regulation S-K. This requirement, which was adopted by the SEC in August 2022, first became applicable for the 2023 proxy season. (go back)

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release