Generative AI in Fintech Market Gains in Finance Technology By USD 16.4 Billion by 2032, Region Share Holding 36.5% Resp

In 2023, North America held a dominant position in the Generative AI in the Fintech market, more than a 36.5% share with revenue reaching USD 0.4 billion...

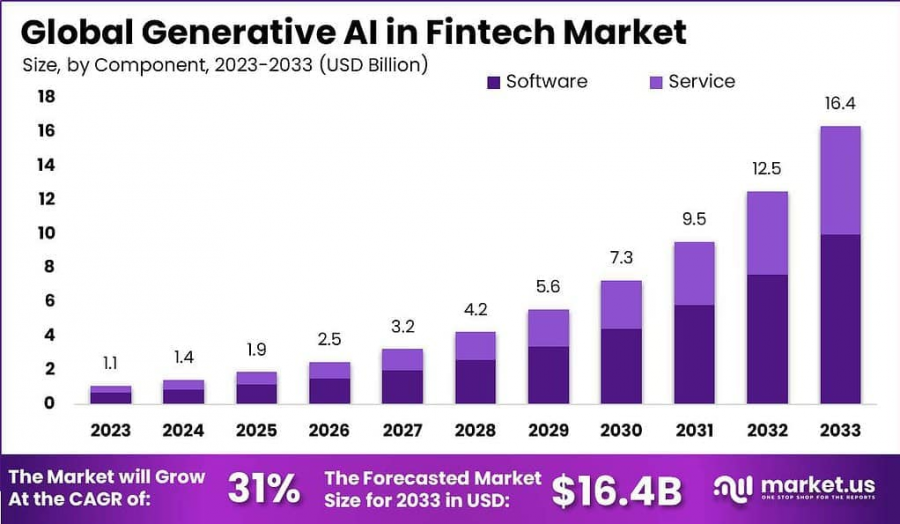

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The Generative AI in Fintech Market is experiencing rapid growth, driven by a surge in demand for automation, improved efficiency, and cost-saving solutions within financial services. The market is projected to reach approximately USD 16.4 Billion by 2032, up from USD 1.1 Billion in 2023, reflecting a robust CAGR of 31% during the forecast period from 2024 to 2032. Several factors contribute to this growth.

Firstly, advancements in machine learning (ML) and natural language processing (NLP) enable fintech companies to analyze vast amounts of financial data better, creating more accurate predictions, risk assessments, and customer insights. The use of generative AI in areas such as fraud detection, algorithmic trading, and automated customer service is revolutionizing the industry, offering both efficiency and scalability.

🔺 Here's a Sample Explaining the Report Structure Grab it Now @ https://market.us/report/generative-ai-in-fintech-market/request-sample/

Secondly, regulatory advancements are fostering greater confidence in AI-driven financial solutions, with governments focusing on data privacy and security policies that protect users. Moreover, financial institutions' increasing adoption of AI to enhance decision-making, reduce errors, and personalize services is creating significant market demand.

As fintech companies continue to innovate with generative AI, investments in AI-powered startups and partnerships are rising, further driving the market. However, challenges such as data privacy concerns and integration with legacy systems need to be addressed to unlock the potential of generative AI in fintech.

Key Takeaways

-- The Global Generative AI in Fintech Market is forecasted to grow from USD 1.1 billion in 2023 to approximately USD 16.4 billion by 2032, registering an impressive CAGR of 31% from 2024 to 2033.

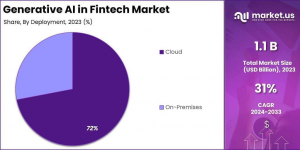

-- In 2023, the Software segment led the market, accounting for over 61% of the market share, while the Cloud segment captured more than 72% of the market share.

-- Fraud Detection emerged as a key application, holding a market share of over 25% in 2023.

North America dominated the market in 2023 with a share of over 36.5%, generating revenues of approximately USD 0.4 billion.

🔺 Get the Full Report at Exclusive Discount (Limited Period Only) @ https://market.us/purchase-report/?report_id=99019

Notable Industry Insights

-- Adoption Rates: By 2023, 82% of financial institutions were either exploring or actively implementing Generative AI solutions to enhance their services.

-- Customer Impact: Banks and financial firms leveraging Generative AI for customer service and personalization are projected to achieve a 20% increase in customer satisfaction scores by 2024.

-- Fraud Detection Efficiency: Integrating Generative AI into anti-money laundering (AML) and fraud detection systems could reduce false positives by 50% by 2024.

-- Credit Risk Assessment: Generative AI is expected to enhance credit risk assessment models by up to 25%, leading to more accurate lending decisions.

-- Regulatory Compliance: The demand for Generative AI in regulatory compliance and reporting is anticipated to grow by 40% in 2023.

-- Investment Returns: The use of Generative AI in financial trading and portfolio management could boost investment returns by 10% by 2024.

-- Job Creation: The adoption of Generative AI in fintech is expected to create over 1 million new jobs globally by 2025, particularly in areas such as AI development, data analysis, and financial advisory services.

-- Cybersecurity Advancements: Integrating Generative AI with cybersecurity tools could reduce data breaches and cyberattacks by 30% by 2024.

-- Insurance Optimization: The application of Generative AI in insurance underwriting and claims processing could result in a 25% reduction in operational costs by 2024.

Experts Review

The Generative AI in the Fintech market is witnessing rapid advancements, driven by government incentives and technological innovations. Governments worldwide are offering tax benefits, subsidies, and grants to promote AI adoption in financial services, encouraging startups and established firms to innovate. Technological breakthroughs, such as advanced NLP models and AI-driven analytics, are revolutionizing customer experience, fraud detection, and compliance processes.

From an investment perspective, the market presents significant opportunities, particularly in areas like fraud prevention, personalized financial services, and regulatory automation. However, risks include data privacy concerns, high implementation costs, and uncertainties surrounding the evolving regulatory environment. Governments are tightening AI regulations, emphasizing transparency, ethical use, and data security, which could challenge companies adapting to compliance standards.

🔺 Click Here To Get a PDF Research Sample (no cost) @ https://market.us/report/generative-ai-in-fintech-market/request-sample/

Consumer awareness around Generative AI in financial services is growing, with users increasingly valuing AI-driven personalization and faster service delivery. However, skepticism persists around data security and trust in AI models, necessitating greater education and transparency from financial institutions.

The technological impact is profound, improving operational efficiency and accuracy in areas like credit risk assessment and portfolio management. Yet, companies must navigate challenges like cybersecurity risks and potential job displacement. Overall, the market is poised for growth, with the right balance of innovation, regulation, and consumer trust.

Report Segmentation

Technology Type: The market is primarily divided into Software and Services. The Software segment holds the largest share, driven by advancements in AI algorithms and machine learning platforms used for fraud detection, risk assessment, and personalized financial services. The Services segment includes AI consulting and system integration, which are growing as businesses seek to incorporate AI into their operations.

Deployment: The market is split into On-premise and Cloud-based solutions. Cloud-based deployment is expected to dominate due to its scalability, cost-efficiency, and ease of access, especially for smaller businesses.

Application: The key applications of generative AI in fintech include Fraud Detection, Risk Management, Customer Service, Wealth Management, and Credit Scoring. Fraud detection and risk management are the largest and most rapidly growing sectors, driven by the need for more accurate and real-time analysis.

Region: Geographically, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest share, followed by Europe, with Asia-Pacific expected to grow at the highest rate due to increasing AI adoption in financial markets.

🔺 Hurry Exclusive Discount For Limited Period Only @ https://market.us/purchase-report/?report_id=99019

Key Market Segments

By Component

-- Service

-- Software

By Deployment

-- On-Premises

-- Cloud

By Application

-- Credit Risk Assessment

-- Chatbots

-- Fraud Detection

-- Market Prediction

-- Algorithmic Trading

-- Other Applications

Drivers

The rapid adoption of Generative AI in fintech is largely driven by the need for enhanced data analysis capabilities, fraud detection, and personalized customer experiences. The increasing demand for automation in financial services and a shift towards cloud-based platforms also contribute to market growth. Moreover, government incentives supporting AI innovation in fintech are encouraging investment and development in the sector.

Restraints

Despite the potential, the adoption of generative AI faces data privacy concerns and ethical considerations. Financial institutions must ensure compliance with stringent regulations such as GDPR, which can slow down the implementation of AI solutions. Additionally, the high cost of AI implementation and a shortage of skilled professionals pose significant challenges to widespread adoption.

Challenges

The integration of AI into existing legacy systems presents a technical challenge, requiring substantial investment and time. Moreover, the complex nature of AI models and algorithms raises concerns about transparency and accountability in decision-making processes, which is critical in the highly regulated financial industry.

Opportunities

The growing demand for AI-driven fraud prevention, credit scoring, and automated wealth management offers lucrative growth opportunities. Additionally, emerging markets are beginning to embrace AI in fintech, presenting untapped potential for companies willing to innovate and invest in these regions.

Key Player Analysis

The Generative AI in the Fintech market is highly competitive, with several key players leading the innovation curve. Companies like OpenAI, IBM, and Google are at the forefront, offering cutting-edge AI solutions that enhance risk management, fraud detection, and financial advisory services. OpenAI’s GPT models are widely integrated into fintech applications, while IBM Watson provides AI-powered analytics for regulatory compliance and customer service.

Nvidia, a major player in AI hardware, supplies the computational power necessary for fintech AI applications, while Microsoft integrates generative AI with its cloud platforms, supporting AI-driven fintech innovation.

Smaller, innovative firms are also making strides, with Darktrace offering AI-based cybersecurity solutions and ThoughtWorks focusing on AI strategy and implementation. These players are capitalizing on market opportunities, such as the growing demand for AI-driven customer support and predictive analytics in financial services.

Overall, partnerships, mergers, and acquisitions are expected to shape the competitive landscape

Open AI

Microsoft Corporation

Google LLC

Genie AI Ltd.

IBM Corporation

MOSTLY AI Inc.

Veesual AI

Adobe Inc.

Synthesis AI

AI

Other Key Players

Recent Developments

Recent developments in the Generative AI in the Fintech market highlight significant advancements in both technology and adoption. Notably, OpenAI has collaborated with leading fintech firms to integrate its GPT models for personalized financial recommendations and automated customer support, enhancing user engagement. Meanwhile, IBM has launched new AI-driven tools aimed at improving regulatory compliance and fraud detection, addressing growing concerns in the financial sector.

In terms of investment, Nvidia recently expanded its offerings with AI hardware solutions tailored for fintech, enabling faster data processing and more efficient machine learning models. This move is expected to fuel growth in AI-powered financial services.

Governments, particularly in the U.S. and EU, are rolling out AI-friendly policies and grants, making it easier for startups and established players to experiment with generative AI technologies. These developments signal a promising future for AI adoption in the fintech space, with increasing integration into core financial processes such as risk assessment and fraud prevention.

Conclusion

The Generative AI in the Fintech market is poised for substantial growth, driven by technological advancements, increasing demand for automation, and strong government incentives. Key players like OpenAI, IBM, and Nvidia are at the forefront of innovation, enabling more efficient fraud detection, risk management, and personalized financial services.

While challenges such as regulatory concerns and consumer trust remain, the market presents significant investment opportunities. With continuous advancements in AI capabilities and a favorable regulatory environment, generative AI is set to reshape the future of the fintech industry.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release