Asset Based Lending Market CAGR to be at 11.12% By 2034 | Leading Global Innovations in Asset-Based Lending Solutions

Asset Based Lending Market Size

The Asset-Based Lending Market fuels businesses with flexible funding solutions. Turning assets into opportunities, it's financing reimagined.

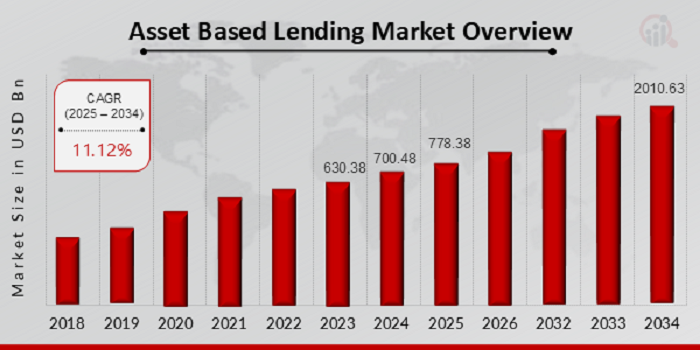

NEW YORK, NY, UNITED STATES, January 10, 2025 /EINPresswire.com/ -- According to a new report published by Market Research Future (MRFR), Asset Based Lending Market is projected to grow from 𝗨𝗦𝗗 𝟳𝟳𝟴.𝟯𝟴 𝗕𝗶𝗹𝗹𝗶𝗼𝗻 in 2025 to 𝗨𝗦𝗗 𝟮𝟬𝟭𝟬.𝟲𝟯 𝗕𝗶𝗹𝗹𝗶𝗼𝗻 by 2034, exhibiting a compound annual growth rate (𝗖𝗔𝗚𝗥) 𝗼𝗳 𝟭𝟭.𝟭𝟮% during the forecast period (2025 - 2034).

The asset-based lending (ABL) market has emerged as a vital segment in the global financial ecosystem, enabling businesses to leverage their tangible and intangible assets to secure funding. Asset-based lending revolves around offering credit facilities that are secured by assets such as inventory, accounts receivable, machinery, or real estate. This financial tool has gained significant traction in recent years, particularly among small and medium enterprises (SMEs) seeking flexible and tailored funding solutions. The market’s growth is propelled by the increasing demand for alternative financing options, the expansion of global trade, and the rise of asset-rich businesses requiring liquidity to scale operations.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗦𝗮𝗺𝗽𝗹𝗲 𝗥𝗲𝗽𝗼𝗿𝘁 (𝗚𝗲𝘁 𝗙𝘂𝗹𝗹 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀 𝗶𝗻 𝗣𝗗𝗙 - 𝟭𝟬𝟬 𝗣𝗮𝗴𝗲𝘀) 𝗮𝘁:

https://www.marketresearchfuture.com/sample_request/23591

𝗠𝗮𝗿𝗸𝗲𝘁 𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀:

• JPMorgan Chas

• TD Bank

• BMO Harris Bank

• Rabobank

• Comerica Bank

• Fifth Third Bank

• Huntington Bank

• PNC Bank

• SunTrust Bank

• Wells Fargo

• CIT Group

• Bank of America

• BBVA

• US Bank

The global asset-based lending market is characterized by intense competition among leading players striving to offer innovative and customer-centric lending solutions. Major participants in the industry include banks, financial institutions, and alternative lenders specializing in structured financing. Key players such as Wells Fargo, JP Morgan Chase, Bank of America, and Citigroup dominate the landscape with extensive product portfolios and robust global networks. Meanwhile, non-bank entities like CIT Group, Bibby Financial Services, and White Oak Global Advisors are capturing market share by catering to niche segments and providing faster and more flexible lending services. These organizations play a pivotal role in shaping the market dynamics, driving product innovation, and enhancing accessibility for underserved sectors.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗲𝗴𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻

Market segmentation within the asset-based lending industry is multifaceted, catering to diverse borrower requirements and asset classes. The market can be broadly segmented based on the type of asset, borrower profile, and end-use industry. By asset type, the lending solutions encompass receivables-based lending, inventory financing, equipment financing, and real estate-backed loans. Borrower segmentation includes SMEs, large enterprises, and startups. Additionally, the demand for asset-based loans spans a wide range of industries, including manufacturing, retail, transportation, healthcare, and technology. Each segment offers unique opportunities and challenges, with lenders tailoring their strategies to align with the specific needs and risk profiles of their target clientele.

𝗗𝗼𝗻’𝘁 𝗠𝗶𝘀𝘀 𝗢𝘂𝘁: 𝗦𝗽𝗲𝗰𝗶𝗮𝗹 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗔𝘃𝗮𝗶𝗹𝗮𝗯𝗹𝗲 𝗪𝗵𝗲𝗻 𝗬𝗼𝘂 𝗕𝘂𝘆 𝗧𝗵𝗶𝘀 𝗥𝗲𝗽𝗼𝗿𝘁 𝗡𝗼𝘄!

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23591

𝗠𝗮𝗿𝗸𝗲𝘁 𝗗𝘆𝗻𝗮𝗺𝗶𝗰𝘀:

The dynamics of the asset-based lending market are shaped by a confluence of factors driving demand and influencing supply. On the demand side, businesses are increasingly turning to asset-based financing due to its flexibility and the ability to secure funding without stringent credit score requirements. This is especially beneficial for companies with substantial assets but irregular cash flows or limited credit histories. On the supply side, the proliferation of non-bank lenders has enhanced competition, leading to competitive interest rates and more innovative loan structures. However, the market faces challenges such as the need for precise asset valuation, the potential for economic downturns impacting asset values, and regulatory complexities that can vary significantly across regions.

𝗥𝗲𝗰𝗲𝗻𝘁 𝗗𝗲𝘃𝗲𝗹𝗼𝗽𝗺𝗲𝗻𝘁𝘀

In recent years, the asset-based lending market has witnessed significant developments that have redefined its trajectory. Technological advancements, particularly in the realms of financial technology (FinTech) and artificial intelligence (AI), have revolutionized the underwriting and risk assessment processes. Lenders now leverage AI-driven algorithms to evaluate borrower credibility and asset quality with greater precision, reducing the turnaround time for loan approvals. Additionally, the pandemic-induced economic disruptions underscored the resilience of asset-based lending as businesses sought liquidity to navigate uncertain market conditions. The growing adoption of digital platforms and blockchain technology is further enhancing transparency, efficiency, and security in asset-backed transactions.

𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀:

From a regional perspective, the US Asset-Based Lending Market exhibits considerable variation in adoption and growth trends. North America leads the market, driven by a well-established financial ecosystem, high asset ownership among businesses, and favorable regulatory frameworks. The United States, in particular, dominates the landscape with a mature lending market and robust demand from manufacturing and retail sectors. Europe follows closely, with countries like the United Kingdom and Germany emerging as key markets due to their dynamic SME sectors and innovative lending practices. Meanwhile, the Asia-Pacific region is experiencing rapid growth, fueled by economic expansion, rising trade activities, and increasing awareness about alternative financing solutions. Countries such as China and India are witnessing a surge in demand for asset-based loans as businesses seek capital to capitalize on emerging market opportunities.

𝗕𝗿𝗼𝘄𝘀𝗲 𝗜𝗻-𝗱𝗲𝗽𝘁𝗵 𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗥𝗲𝗽𝗼𝗿𝘁 -

https://www.marketresearchfuture.com/reports/asset-based-lending-market-23591

The future of the asset-based lending market appears promising, underpinned by evolving business models, technological integration, and the growing emphasis on sustainability. As businesses worldwide continue to prioritize liquidity and financial flexibility, asset-based lending is set to play an instrumental role in addressing these needs. The integration of environmental, social, and governance (ESG) principles into lending practices is also gaining momentum, reflecting a broader industry shift toward sustainable and responsible financing.

In conclusion, the asset-based lending market serves as a critical enabler for businesses of all sizes, providing accessible and adaptive financing solutions. Its ongoing evolution, driven by market dynamics, technological advancements, and regional developments, underscores its resilience and relevance in the modern financial landscape. As the industry navigates challenges and capitalizes on emerging opportunities, asset-based lending is poised to remain a cornerstone of global financial systems, fostering economic growth and innovation across sectors.

𝗘𝘅𝗽𝗹𝗼𝗿𝗲 𝗠𝗥𝗙𝗥’𝘀 𝗥𝗲𝗹𝗮𝘁𝗲𝗱 𝗢𝗻𝗴𝗼𝗶𝗻𝗴 𝗖𝗼𝘃𝗲𝗿𝗮𝗴𝗲 𝗜𝗻 𝗜𝗖𝗧 𝗗𝗼𝗺𝗮𝗶𝗻:

𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗜𝗻𝗳𝗼𝗿𝗺𝗮𝘁𝗶𝗼𝗻 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.marketresearchfuture.com/reports/business-information-market-26458

𝗛𝗿 𝗧𝗲𝗰𝗵 𝗖𝗼𝗻𝘀𝘂𝗹𝘁𝗶𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.marketresearchfuture.com/reports/hr-tech-consulting-market-26612

𝗠𝗼𝘂𝗻𝘁𝗮𝗶𝗻 𝗔𝗻𝗱 𝗦𝗸𝗶 𝗥𝗲𝘀𝗼𝗿𝘁 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.marketresearchfuture.com/reports/mountain-and-ski-resort-market-26530

𝗢𝗧𝗧 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗠𝗲𝘀𝘀𝗮𝗴𝗶𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.marketresearchfuture.com/reports/ott-business-messaging-market-26736

𝗔𝗻𝗶𝗺𝗮𝘁𝗶𝗼𝗻 𝗔𝗻𝗱 𝗩𝗙𝗫 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.marketresearchfuture.com/reports/animation-and-vfx-market-27261

𝗔𝗯𝗼𝘂𝘁 𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗙𝘂𝘁𝘂𝗿𝗲:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

𝗖𝗼𝗻𝘁𝗮𝗰𝘁:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release