Global POS Terminal Market - NFC-ready POS Terminals are Gaining Immense Popularity Worldwide | Arizton

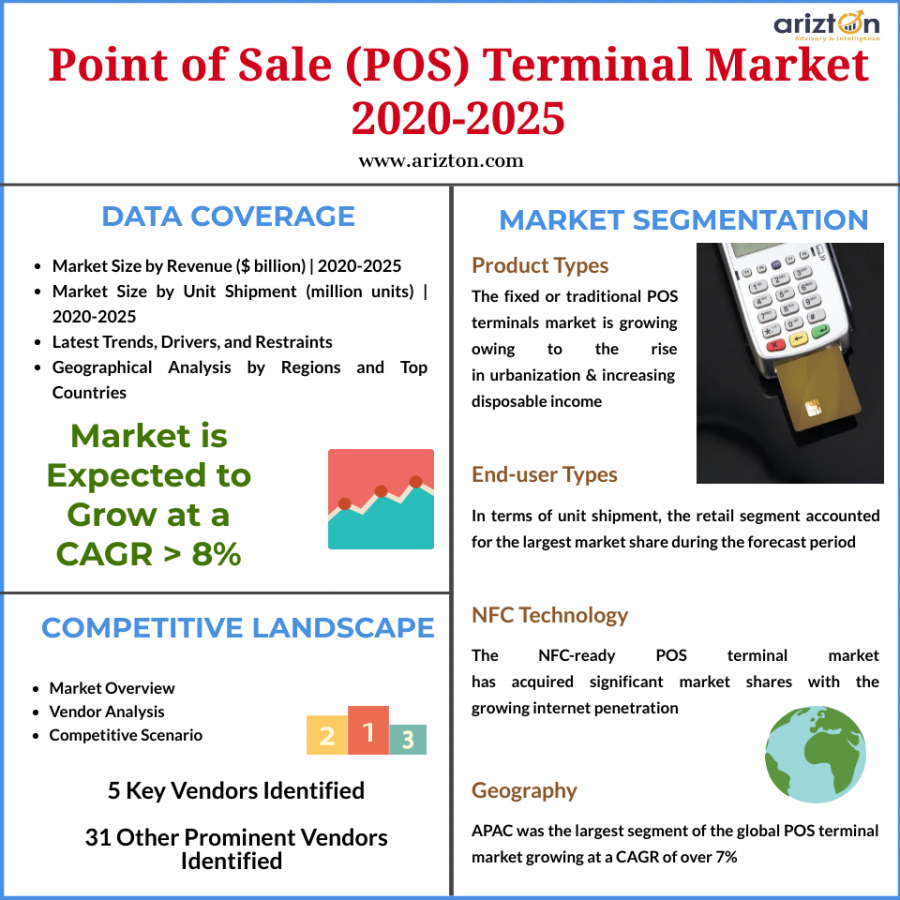

The global POS terminal market by revenue is expected to grow at a CAGR of over 8% during the period 2019–2025.

CHICAGO, IL, UNITED STATES, January 29, 2020 /EINPresswire.com/ -- The global point of sale market is growing, with the presence of vendors such as Ingenico, Fujian Newland, Verifone, Xinguodu, and PAX Global, offering a diverse range of products. The demand for POS payment terminals has grown in countries such as the US, China, and India due to the booming retail industry and the shift in unorganized markets. mPOS terminals are increasingly marking their presence among end-users worldwide. The penetration of these devices is growing rapidly across the world, boosted by the growing demand in APAC countries. The global mPOS terminal market is expected to register a CAGR of over 9% in terms of revenue during the period 2019−2025.

Futuristic inventions in transaction and payment technology and the growth in the complementary security technologies are further expected to boost investors’ confidence in the market. Thus, the introduction of upgrades is likely to fuel the market growth during the forecast period. However, an important reason for the increasing acceptance of point of sale terminal among merchants is urbanization. Urbanization leads to the creation of better job opportunities, which, in turn, lead to the improvement in living standards and an increase in per capita disposable incomes. Urbanization also leads to a change in the sociological profile of end-users that can alter the demography as well as sociography. This also results in a change of lifestyle, improvement in the living conditions, high-spending sentiments, awareness of the latest technology, reduced insecurity, and improved confidence.

The global POS terminal market by revenue is expected to grow at a CAGR of over 8% during the period 2019–2025.

The following factors are likely to contribute to the growth of the POS terminal market during the forecast period:

Increase in Digital Payments

Penetration of EMV-compliant POS Terminals

Introduction of Cloud-based POS Systems

High Demand from Healthcare and Retail Industries

The study considers the present scenario of the POS terminal market and dynamics for the period 2019−2025. It covers a detailed overview of several market growth enablers, restraints, and trends. The report covers both the demand and supply aspects of the market. It profiles and examines leading companies and other prominent companies operating in the market.

The research report includes detailed segmentation by product type, NFC technology, application, end-users, compliance, and geography.

Insights by NFC Technology

The NFC-ready segment has witnessed a major boost as internet penetration across the globe has significantly grown in the recent decade. With the high adoption of smart devices, along with the availability of inexpensive mobile data plans, has increased the adoption of NFC-ready segments. NFC-ready mPOS systems are creating abuzz among merchants, and the shipment is witnessing an upward trend. The market displayed strong momentum in 2019 and witnessed a shipment of over 58 million. Brazil, Turkey, and China are witnessing high adoption of NFC-ready POS terminals. Non-NFC POS terminals are still prevalent in the market as these devices have been widely used in several application end-users such as malls and shopping complexes. These devices are observing growth in developing economies as the market in these regions has slow in adopting new NFC technology.

Market Segmentation by NFC Technology

NFC-ready

Non-NFC

Insights by Product Type

Fixed or hardware point of sale systems have witnessed a steady growth in recent past years on account of the high adoption in department stores, convenience stores, specialty stores, and online marketplaces. The growing urbanization and the increase in consumer disposable income are driving the growth. Increased functionalities such as inventory management and execution of loyalty programs are increasing the popularity of fixed POS terminal. Moreover, these devices are witnessing high preference among restaurants and retail stores because they offer several features and functionalities. The increase in mobile payment applications and cashless transactions is driving the mPOS segment. The segment is expected to experience an absolute growth of 75% growth in terms of revenue during the period 2019–2025.

Market Segmentation by Product Type

Fixed/traditional POS

Mobile POS

Insights by Compliance

The EMV point of sale segment is expected to grow at the highest CAGR during the forecast period. The presence of strong transaction security features in EMV cards is increasing segment growth. The segment has witnessed a significant boom in recent times. Emerging markets such as India have fixed structured regulations to promote EMV terminals. The Reserve Bank of India (RBI) has mandated all banks to replace their existing magnetic stripe-only cards with EMV chip cards, thereby increasing the demand for EMV cards. Moreover, 80% of developed economies have adopted EMV-based cards with Canada and the US leading the race. The adoption of non-EMV POS terminals is declining on the YOY basis due to stringent regulatory and security compliance for EMV card usage. The non-EMV segment is likely to be phased out slowly in developed economies during the forecast period as several governments such as the US have mandated the use of chip-based cards in their respective countries.

Market Segmentation by Compliance

EMV

Non-EMV

Insights by End-user

The retail segment is the fastest adopters of mPOS systems. With the increasing acceptance of digital payment solutions, several economies in the APAC region are undergoing rapid digital transformation. The demonetization initiative by the government of India has resulted in an immense adoption of credit and debit cards. Moreover, the use of most advanced POS and payment systems in supermarkets, malls, and large retail stores across the world is increasing the share of the retail segment. Restaurants are another major end-user of POS systems. Advanced systems enhance customer experience and help to simplify business in restaurants. POS technology helps food and beverage operators in cash management and collaborates with payment service providers to process the order and retain financial controls.

Market Segmentation by End-user Type

Retail

Restaurants

Warehouse & Distribution

Entertainment

Hospitality

Healthcare

Insights by Geography

The APAC region has captured a large share of the global financial cards and payment market in recent years. China has emerged as the fastest-growing region, followed by India. Debit and credit cards are expected to witness growth in the future. However, rapid digitization in the region is aiding in the growth of the market.

Market Segmentation Geography

China

Japan

Australia

India

Vietnam

Germany

France

UK

Spain

Italy

Nordic

US

Canada

MEA

South Africa

Saudi Arabia

UAE

Brazil

Mexico

Download the sample report here!

Key Vendor Analysis

The competitive scenario in the global point of sale market is currently intensifying. The rapidly changing technological environment could adversely affect vendors as continual innovations and upgrades characteristic the market. The present scenario is driving vendors to change and refine their unique value proposition to achieve a strong market presence. The market is moderately fragmented. Global players are providing POS terminal with high functionality and design. All these companies have a presence in the three major geographical regions - North America, APAC, and Europe. However, there are local vendors providing products with similar specifications at low prices. This has intensified price wars among vendors.

Key Vendors

Ingenico Group

Fujian Newland Payment Technology

PAX Global Technology

Verifone Systems or Verifone

Shenzhen Xinguodu Technology (NEXGO)

Other Prominent Vendors – Fiserv, Cybernet, SZZT Electronics, USA Technologies, VISIONTEK Linkwell Telesystems, Centerm, BBPOS, Dspread Technology, Castles Technology, Bitel Corporation, NEW POS TECHNOLOGY LIMITED (NEWPOS), Sunyard System Engineering, Spire Payments, Shenzhen Justtide, Spectra Technologies, Vanstone Electronic (Beijing) Co., Ltd, Datecs, Yarus, wizarPOS, YouTransactor, Equinox Payment, Bluebird, Worldline, Lian Yu (UIC), Panasonic Corporation, Gertec, Shenzhen Kaifa Technology Co. Ltd., Toshiba Tec Corp., M.POS, and Nayax

Jessica

Arizton Advisory & Intelligence

+1 312-235-2040

email us here

Distribution channels: Business & Economy, Companies, Consumer Goods, Retail, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release