Auto Loan Market Trends

Auto Loan Market Research Report By, Loan Type, Loan Term, Interest Rate Type, Loan Amount, Vehicle Type, Regional

HI, UNITED STATES, January 15, 2025 /

EINPresswire.com/ -- The global

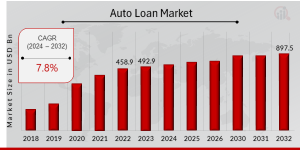

Auto Loan Market has experienced significant expansion and is projected to grow further as consumer demand for vehicle financing solutions continues to rise. In 2022, the market size was estimated at USD 458.9 billion. This value increased to USD 492.9 billion in 2023 and is expected to reach a staggering USD 897.5 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 7.8% during the forecast period (2024–2032).

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

➤ Rising Vehicle Ownership and Demand for Financing

Increasing global vehicle ownership, fueled by urbanization and rising disposable incomes, is a primary driver of the auto loan market. Both new and used vehicle buyers are seeking flexible financing options, contributing to market growth.

➤ Expansion of Digital Loan Platforms

Digital transformation in the financial sector has streamlined auto loan application and approval processes. Online platforms and mobile applications enable consumers to compare loan options, access personalized rates, and receive faster approvals, driving market adoption.

➤ Increasing Demand for Electric Vehicles (EVs)

The global push for sustainability and environmental conservation has boosted the adoption of electric vehicles. Governments and financial institutions are offering tailored loan options and incentives for EV purchases, creating new growth opportunities in the auto loan market.

➤ Attractive Interest Rates and Flexible Loan Terms

Financial institutions are competing to offer attractive interest rates, low down payments, and flexible loan tenures to cater to a diverse range of consumers. This has made vehicle financing more accessible to a broader audience.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬

https://www.marketresearchfuture.com/sample_request/22818

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐀𝐮𝐭𝐨 𝐋𝐨𝐚𝐧 𝐌𝐚𝐫𝐤𝐞𝐭

• Exeter Finance

• U.S. Bank

• Toyota Motor Credit Corporation

• Bank of America

• Ally Financial

• Truist Financial

• PNC Financial Services Group

• Citigroup

• Capital One

• GM Financial

• J.P. Morgan

• Huntington Bancshares

• Wells Fargo

• Santander Consumer USA

• Ally Lending

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.marketresearchfuture.com/reports/auto-loan-market-22818

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

The auto loan market is segmented based on type, loan provider, vehicle type, and region for a detailed analysis.

1. By Type

• Direct Loans: Loans offered directly by banks and financial institutions to consumers.

• Indirect Loans: Loans facilitated by car dealerships in partnership with financial institutions.

2. By Loan Provider

• Banks: Traditional lenders offering a wide range of auto financing options.

• Credit Unions: Known for their competitive interest rates and customer-centric services.

• Non-Banking Financial Companies (NBFCs): Increasingly popular due to their quicker loan processing and flexibility.

3. By Vehicle Type

• New Vehicles: Comprising the majority share of auto loans due to high ticket sizes.

• Used Vehicles: Rapidly growing segment as consumers seek affordable car ownership options.

• Electric Vehicles: Emerging as a lucrative segment with government incentives and specialized financing plans.

4. By Region

• North America: Dominates the market with a well-established auto financing industry and high vehicle ownership rates.

• Europe: Growth driven by rising adoption of EVs and innovative loan offerings.

• Asia-Pacific: Fastest-growing region due to increasing vehicle sales in emerging economies like China, India, and Indonesia.

• Rest of the World (RoW): Steady growth anticipated in Latin America, the Middle East, and Africa, driven by improving financial inclusion and rising vehicle demand.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰:

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22818

The auto loan market is on a strong growth trajectory, supported by advancements in digital lending, evolving consumer preferences, and the increasing shift towards electric vehicles. As financial institutions and fintech companies continue to innovate with competitive loan products and seamless user experiences, the market is poised for sustained expansion. With opportunities across regions and segments, the auto loan market is set to play a crucial role in shaping the future of global vehicle financing.

Related Report –

Islamic Finance Market

Magneto Elastic Torque Sensor Market

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here