Zinger Key Points

- Chevron stock hits a 52-week high, with Buffett holding 6.60% - but is it too hot to buy?

- Technicals remain bullish, but overbought RSI suggests a pullback might offer a better entry point.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Warren Buffett isn’t one to chase momentum, but Chevron Corp CVX has been on a tear, hitting a fresh 52-week high at $168.96.

With the stock up 14.49% year to date and 7.21% in the past month, investors are asking: Is it time to jump in, or is this rally running on fumes?

The Buffett Factor

Buffett's Berkshire Hathaway holds 118.6 million CVX shares, accounting for 6.42% of his portfolio. That's a serious vote of confidence, with Berkshire owning 6.60% of the company's outstanding shares. But is it a reason to follow suit?

Read Also: Wall Street’s High Rollers: Berkshire Hathaway, RTX, Kinross Gold Hit 52-Week Peaks

CVX Stock Technicals Flash Green

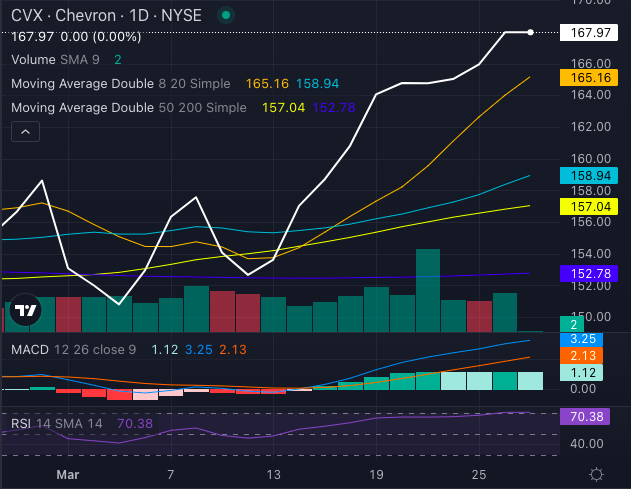

Chart created using Benzinga Pro

CVX stock, at $167.97, sits comfortably above its key moving averages:

- Eight-day simple moving average (SMA): 165.16 (Bullish)

- 20-day SMA: 158.94 (Bullish)

- 50-day SMA: 157.04 (Bullish)

- 200-day SMA: 152.78 (Bullish)

Add a Moving Average Convergence Divergence (MACD) of 3.25; the technical case remains bullish. However, the Relative Strength Index (RSI) of 70.38 raises a yellow flag – it's in overbought territory, suggesting some cooling off could be ahead.

Strong Trend, But Some Selling Pressure

While the CVX stock is riding high above its five-, 20-, and 50-day exponential moving averages, there are signs of slight selling pressure. This could indicate traders are locking in profits, which may slow the stock's ascent in the short term.

The Verdict: Bullish Or Wait?

Chevron is technically bullish, backed by Buffett's long-term conviction and solid upward momentum. But with RSI signaling an overheated stock, waiting for a slight pullback could offer a better entry point.

If you’re looking to ride the energy wave, CVX stock remains a strong contender – but chasing highs comes with risks.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.