Mazagon Dock vs Cochin Shipyard: Which has better upside potential?

After a 1,500% plus rally since August 2022, shipbuilding stocks Mazagon Dock and Cochin Shipyard have seen a sharp correction. As India pushes to establish itself as a global shipbuilding market, which of these stocks has a better upside potential?

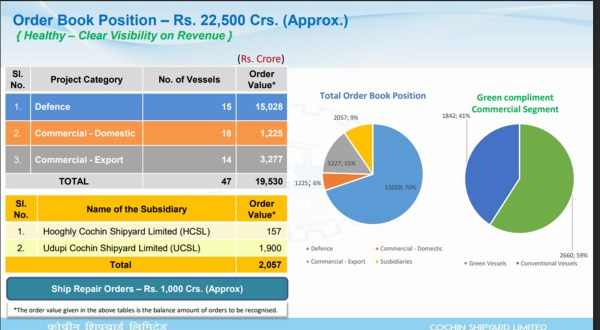

Cochin Shipyard’s shipbuilding order book is spread across defence (70%) and commercial and subsidiaries (30%). (Credit: X/@cslcochin)

Cochin Shipyard’s shipbuilding order book is spread across defence (70%) and commercial and subsidiaries (30%). (Credit: X/@cslcochin)India’s shipbuilding industry remained in the shadows until 2020 when the government ramped up efforts to promote self-reliance in defence products. It was then that a large share of the defence budget was allocated to modernisation and the Indian Navy.

The key beneficiary of this move was India’s largest warship builder, Mazagon Dock Shipbuilders. The company launched its IPO in October 2020, with the stock listing at a 50% premium from the issue price of Rs 145. But that was just the start.

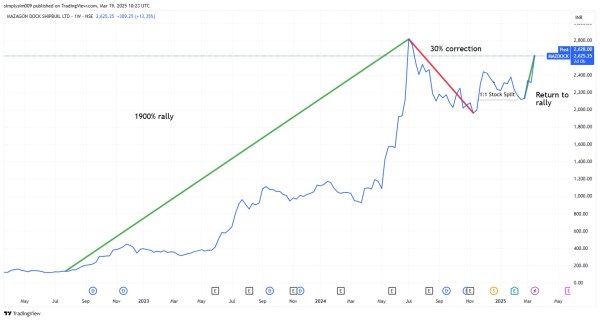

Mazagon Dock stock became a multi-bagger, rallying 1,950% between August 1, 2022 and July 5, 2024, before correcting 30% by November. The rally resumed after the company announced its first-ever stock split of 1:1.

By February 2025, the anticipation around the Union Budget triggered another dip. The stock returned to a rally in March 2025, surging 23%.

Fig 1: Mazagon Dock Share Price Momentum (August 2022 to March 2025) (Source: Trading View)

Fig 1: Mazagon Dock Share Price Momentum (August 2022 to March 2025) (Source: Trading View)

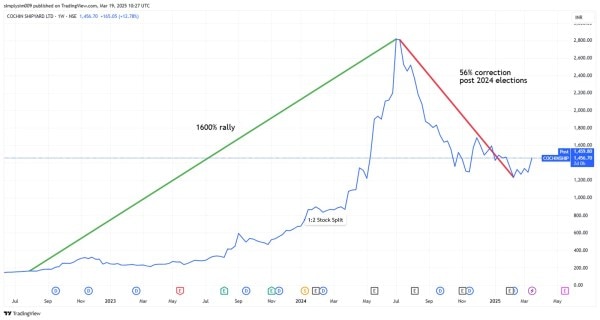

Similarly, the stock price of Cochin Shipyard, India’s largest shipbuilding and maintenance facility, surged as much as 1,600% between August 2022 and July 5, 2024. This momentum was supported by a 1:2 stock split in January 2024. However, the stock price more than halved between July 2024 and February 2025. It has jumped 20% since then.

This raises the question: Do Mazagon Dock and Cochin Shipyard have more upside?

Fig 2: Cochin Shipyard Share Price Momentum (August 2022 to March 2025) (Source: Trading View)

Fig 2: Cochin Shipyard Share Price Momentum (August 2022 to March 2025) (Source: Trading View)

India’s shipbuilding market: challenges and growth potential

India ranks 20th globally in the commercial shipbuilding market, with a 0.05% market share. High costs, long delivery time, and lack of cheap financing options, make second-hand foreign ships cheaper than new orders from Indian shipyards. Even the Indian Navy has relied on foreign companies for its ships. India’s first aircraft carrier INS Vikramaditya, was a second-hand Russian-origin vessel.

However, the government has introduced policies, such as the Shipbuilding Financial Assistance Policy (2016-2026) and Atmanirbhar Bharat in defence, to boost shipbuilding capacity.

Cochin Shipyard delivered India’s first Indigenous Aircraft Carrier (IAC-1) INS Vikrant to the Indian Navy in July 2022. The IAC-1 was a Rs 20,000 crore defence order and constituted 57% of Cochin Shipyard’s 5-year revenue (FY20-24).

Contribution of IAC-1 to Cochin Shipyard’s Revenue:

| Revenue (Rs Crore) | FY20 |

FY21 |

F22 | FY23 | FY24 |

| Cochin Shipyard | 3,422.49 | 2,818.90 |

3,190.00 |

2,330.46 |

3,645.28 |

| IAC | 2377.46 |

2009.25 |

1792.66 |

1424.18 | 1202.69 |

| IAC revenue Contribution | 69% | 71% | 56% |

61% |

33% |

Source: Cochin Shipyard Annual Reports

INS Vikrant was a game changer for Indian shipbuilding. It put India among a select group of nations — the US, UK, Russia, France, and China — that have the capability to build aircraft carriers. After the July 2022 IAC delivery, investors rushed to buy shipbuilding stocks, making them multibaggers.

This gives us a fair idea of how important orders are for shipbuilders, especially large defence orders.

The government wants to make India a key player in global shipbuilding and improve the nation’s rank from 20th to among the top 10 by 2030.

How is Mazagon Dock different from Cochin Shipyard?

Mazagon Dock is India’s defence PSU that builds submarines and destroyers for the Indian Navy. It built the first ‘Made in India’ submarine, INS Shalki, in 1992. In October 2015, it established a ‘Make in India’ department to advance indigenisation. By FY24, it indigenised 57 key items and systems for ships and submarines, achieving 75% indigenous content in warships.

Mazagon Dock earns 97% of its revenue from shipbuilding and has little presence in Maintenance, Repair, and Overhaul (MRO). It is expanding its presence in merchant ships and oil sector equipment. Over the next few years, it plans to invest Rs 5,000 crore to double its shipbuilding and repair capacity (from 21 vessels at present) and build larger ships.

On the other hand, Cochin Shipyard has a strong presence in MRO. It builds repairs and refits all types of vessels including tankers, product carriers, bulk carriers, passenger vessels, and air defence ships. This gives it a regular source of income. So far, Cochin Shipyard’s biggest order was INS Vikrant.

Cochin Shipyard commissioned the International Ship Repair Facility (ISRF) in January 2024 for a capex of around Rs 2,769 crore.

While Mazagon Dock is expanding its shipbuilding capacity, Cochin Shipyard is expanding its ship repair capacity. How does this impact their financials and order books?

Order book: Mazagon Dock versus Cochin Shipyard

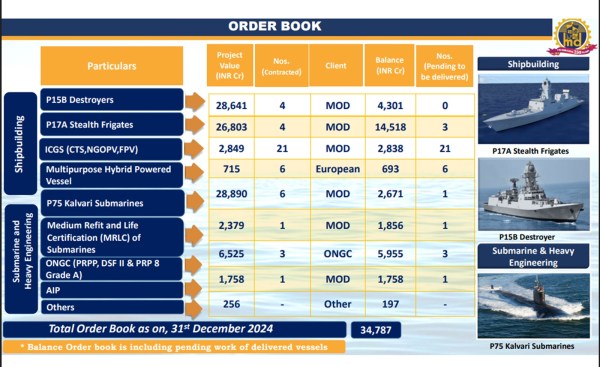

Mazagon Dock has several larger defence orders in its book. Its Rs 34,787 crore order book as of December 31, 2024 includes three P17A stealth frigates and one P75 Kalvari Submarine. It takes around six to seven years from the date of order to deliver the first submarine, and one year for a submarine.

Mazagon Dock order book as of 31 December 2024 (Source: Mazagon Dock Q3FY25 Earnings Presentation)

Mazagon Dock order book as of 31 December 2024 (Source: Mazagon Dock Q3FY25 Earnings Presentation)

The execution of the current orders would continue in FY26, which could keep Mazagon Dock’s revenue and profits at or above the FY25 levels. The order mix determines the future revenue and earnings growth potential.

Meanwhile, Cochin Shipyard’s shipbuilding order book is spread across defence (70%) and commercial and subsidiaries (30%). It also has around Rs 1,000 crore worth of ship repair orders.

Cochin Shipyard order book as of 30 June 2024 (Source: Cochin shipyard Q1FY25 Earnings Presentation)

Cochin Shipyard order book as of 30 June 2024 (Source: Cochin shipyard Q1FY25 Earnings Presentation)

An order win brings visibility to the company’s future revenue, leading to a jump in the stock price. The most recent example of this is Mazagon Dock and Cochin Shipyard stocks surging 8% and 7.5%, respectively on March 19, after German lawmakers unlocked billions of euros in military spending, creating defence export opportunities for India.

Brokerages bearish

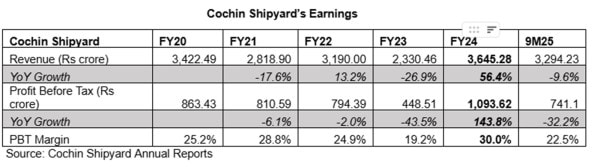

Cochin Shipyard recorded its best-ever earnings in FY24, with revenue up 56.4% to an all-time high of Rs 3,645 crore. Its profit before tax (PBT) surged 143.8% to Rs 1,093.6 crore, representing a PBT margin of 30%.

Cochin Shipyard earnings

Cochin Shipyard earnings

With IAC revenues behind it, Kotak Institutional Equities expects Cochin Shipyard’s PBT margins to normalise to 17-19%. It expects revenue growth to slow from 13% in FY25 to 3% in FY26 to -7% in FY27. It has a ‘sell’ rating on Cochin Shipyard with a price target of Rs 830, a 43% downside from the current trading price of Rs 1,460.

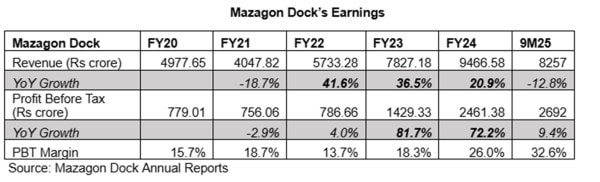

Mazagon Dock has been reporting strong revenue and PBT for the last three years as it executes on its current order book. Its FY24 revenue surged 20.9% to Rs 9,466.58 crore and PBT surged 72% to Rs 2,461.8 crore, representing a 26% PBT margin.

Mazagon Dock’s earnings

Mazagon Dock’s earnings

The company expects its FY25 revenue and PBT margin to be higher than FY24’s as it is still executing on the order book that drove its earnings. However, the growth rate will slow unless large defence orders come.

Analysts are concerned that Mazagon Dock may not be able to keep up with the 3-year sales compounded annual growth rate (CAGR) of 33% and profit CAGR of 47%, which makes a 38.7x price-to-earnings (PE) valuation look stretched. Its over 4-year PE median of 15.9x since its October 2020 IPO makes the stock look overvalued.

But then again, it all boils down to future order books. If the bid for large defence orders fructify, high-profit margins could justify the 38.7x PE.

Similar concerns exist for Cochin Shipyard, whose 46.6x PE ratio is well above its 7-year PE median of 11x. The company’s 3-year sales and profit CAGR are 9% and 10%, respectively. An IAC-2 order would be a catalyst for this stock.

Which is a better buy: Mazagon Dock or Cochin Shipyard?

While both stocks have a strong balance sheet and a healthy dividend payout, the last two year’s rally and record earnings have slowed future upside potential in the short term.

The future growth potential of both stocks hinges on the order book.

ICICI Securities and JP Morgan retain a ‘sell’ and ‘neutral’ recommendation, respectively. They see a strong order inflow opportunity for Mazagon Dock but remain cautious because the uncertainty around timelines of order and execution could decelerate revenue growth rate and normalise margins. As for Cochin Ship, Kotak Institutional Equities retains a sell recommendation as margins normalise and there is low potential for a major defence order in the near term.

While brokerages remain bearish for the short term, both the stocks could continue to grow in the long term as the government pushes the country’s shipbuilding capacity and brings in domestic and export orders for the shipbuilders.

It’s how they are able to tide over the near term that’s the key focus right now.

Note: We have relied on data from Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

Puja Tayal is a financial writer with over 17 years of experience in the field of fundamental research.

Disclosure: The writer and his dependents do hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Must Read

Buzzing Now

Mar 22: Latest News

- 01

- 02

- 03

- 04

- 05