New Geophysics Outline Structures Controlling High-Grade Mineralisation at Kharmagtai

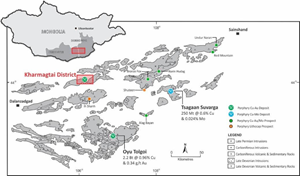

/EIN News/ -- TORONTO, Sept. 15, 2020 (GLOBE NEWSWIRE) -- Xanadu Mines Ltd (ASX: XAM, TSX: XAM) (Xanadu or the Company) is pleased to advise that it has further enhanced the prospectivity of the Kharmagtai copper and gold Project (Figures 1 and 2), located within the South Gobi region of Mongolia, following receipt of highly encouraging new geophysical data.

Highlights

- New data from Controlled Source Audio Magneto-Tellurics (CSAMT) reveals a large-scale system dissected by a series low-angle faults controlling high-grade mineralisation

- Extensional targets identified adjacent to existing resources at Stockwork Hill and Copper Hill

- New targets identified stretching the full +7km length of the Kharmagtai Intrusive Complex

- Drilling program expanded, with a fourth diamond drill rig added to test new targets

Xanadu’s Chief Executive Officer, Dr Andrew Stewart, said “This new data provides a step-change in unravelling the structural controls and targeting high-grade mineralisation at Kharmagtai. It expands the potential of the system and shows that historical drilling may not have been deep enough to effectively test the extent of mineralisation. We’re excited by these findings and are mobilising a fourth drill rig from next week specifically to test these new drill targets in a progressive and systematic manner.”

Survey Overview

The objective of the geophysical CSAMT survey was to identify the key low-angle structures across the Project to allow a 3D structural framework to be developed, from which high-grade targets can be easily defined.

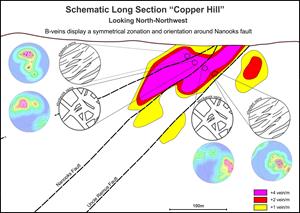

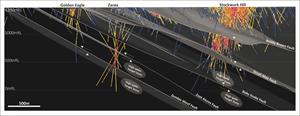

These low-angle structures are observed to both offset and control the high-grade mineralisation. Structural analysis of mineralisation from the existing deposits, focusing on high-grade mineralisation has demonstrated that low angle structures not only dislocate zones of mineralisation slightly (up to 100m) but at some stage during their history have acted as feeder zones for the very high-grade copper and gold event (Figure 3). Understanding the structural framework for the district has become a key to unlocking the full potential of the Kharmagtai Project.

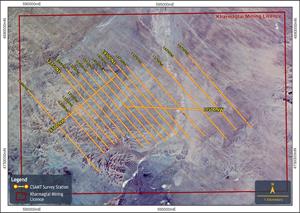

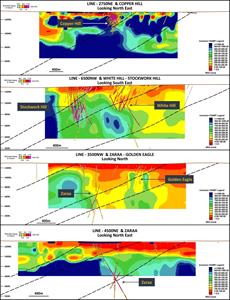

A total of 60.5-line kilometres of CSAMT has been conducted in 19 lines and 603 stations (Figure 2). Receiver spacings were set at mainly 100m spacings to allow a high-resolution product and a depth of investigation up to 1,000m from surface (Figures 4 and 5).

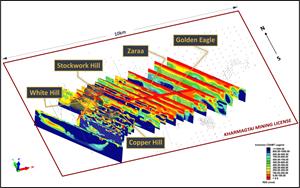

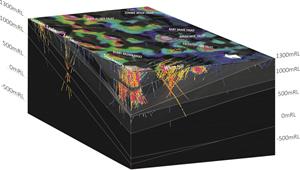

All key previously identified faults are visible in the CSAMT data and numerous other structures are visible and are being validated using the existing drilling, surface mapping and other geophysical datasets. Critically, the low angle structures related to high-grade mineralisation at Stockwork Hill and Copper Hill are clearly mapped and can be traced across the lease. From this data, a 3D structural and geological model is being developed and the drill targets in the current drill program refined to target where the mineralised intrusives are bisected by the structures controlling high-grade mineralisation (Figures 6 and 7).

Current Drill Program

Xanadu is focused on expanding known high-grade zones of mineralisation and discovering new, previously undrilled zones of copper and gold, aiming to define Kharmagtai as a world-class copper and gold project. The first phase of this strategy is underway, designed to understand the scale of the mineralised system through extensional drilling with several large step-outs from known zones. This phase will map the mineral system by following broad geological/geochemical trends, allowing for more surgical drill targeting in the second phase.

A project-scale 23,000m drilling programme is underway with drill rigs being expanded to test these new targets, with an extra diamond drill rig scheduled to arrive next week.

Response to COVID-19

Currently, COVID-19 has had minimal impact on the Company’s exploration activities in Mongolia. All necessary health and safety precautions are being taken and the Company remains well-funded to continue operations throughout this period.

Correction

Xanadu’s ASX | TSX Announcement issued on 31 August 2020, included the following in the ‘Highlights’ section: Copper Hill CSAMT geophysical survey has commenced with results expected by early August. Xanadu advises that this should have read early September.

About Xanadu Mines

Xanadu is an ASX and TSX listed Exploration company that discovers and defines globally significant porphyry copper-gold assets in Mongolia. We give investors exposure to large scale copper-gold discoveries and low-cost inventory growth, and we create liquidity events for shareholders at peak value points in the mining life cycle. Xanadu maintains a portfolio of exploration projects and remains one of the few junior explorers on the ASX or TSX who control an emerging Tier 1 copper-gold deposit in our flagship Kharmagtai project. For information on Xanadu visit: www.xanadumines.com.

Andrew Stewart

CEO

Xanadu Mines Ltd

Andrew.stewart@xanadumines.com

+61 409 819 922

This Announcement was authorised for release by Xanadu’s Board of Directors.

Figures and Tables

FIGURE 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6fa02fb6-1b5f-4a62-aca8-3a3ab966a4e1

FIGURE 2 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5e854075-3cf0-4184-b590-c92f19166335

FIGURE 3 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6842fed1-9697-471f-adc8-818146df3526

FIGURE 4 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f6c18c9d-331b-4c35-a242-1cf35b41fb04

FIGURE 5 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5476996e-5b67-41c6-ab95-03b83c905cc7

FIGURE 6 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ba151fd1-8849-4d7d-b835-ff645e0db7d2

FIGURE 7 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d602571e-5059-4e37-96c3-6369fc3d5ff4

Statements and Disclaimers

Mineral Resources and Ore Reserves Reporting Requirements

The 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code 2012) sets out minimum standards, recommendations and guidelines for Public Reporting in Australasia of Exploration Results, Mineral Resources and Ore Reserves. The Information contained in this Announcement has been presented in accordance with the JORC Code 2012.

Competent Person Statement

The information in this announcement that relates to exploration results is based on information compiled by Dr Andrew Stewart, who is responsible for the exploration data, comments on exploration target sizes, QA/QC and geological interpretation and information. Dr Stewart, who is an employee of Xanadu and is a Member of the Australasian Institute of Geoscientists, has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as the “Competent Person” as defined in the 2012 Edition of the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves and the National Instrument 43-101. Dr Stewart consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

Copper Equivalent Calculations

The copper equivalent (eCu) calculation represents the total metal value for each metal, multiplied by the conversion factor, summed and expressed in equivalent copper percentage with a metallurgical recovery factor applied. The copper equivalent calculation used is based off the eCu calculation defined by CSA in the 2018 Mineral Resource Upgrade.

Copper equivalent (eCu) grade values were calculated using the following formula:

eCu = Cu + Au * 0.62097 * 0.8235,

Where Cu = copper grade (%); Au = gold grade (gold per tonne (g/t)); 0.62097 = conversion factor (gold to copper); and 0.8235 = relative recovery of gold to copper (82.35%).

The copper equivalent formula was based on the following parameters (prices are in USD): Copper price = 3.1 $/lb (or 6,834 $ per tonne ($/t)); Gold price = 1,320 $ per ounce ($/oz); Copper recovery = 85%; Gold recovery = 70%; and Relative recovery of gold to copper = 70% / 85% = 82.35%.

Forward-Looking Statements

Certain statements contained in this Announcement, including information as to the future financial or operating performance of Xanadu and its projects may also include statements which are ‘forward‐looking statements’ that may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions. These ‘forward-looking statements’ are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Xanadu, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Xanadu disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this Announcement or to reflect the occurrence of unanticipated events, other than required by the Corporations Act 2001 (Cth) and the Listing Rules of the Australian Securities Exchange (ASX) and Toronto Stock Exchange (TSX). The words ‘believe’, ‘expect’, ‘anticipate’, ‘indicate’, ‘contemplate’, ‘target’, ‘plan’, ‘intends’, ‘continue’, ‘budget’, ‘estimate’, ‘may’, ‘will’, ‘schedule’ and similar expressions identify forward‐looking statements.

All ‘forward‐looking statements’ made in this Announcement are qualified by the foregoing cautionary statements. Investors are cautioned that ‘forward‐looking statements’ are not guarantee of future performance and accordingly investors are cautioned not to put undue reliance on ‘forward‐looking statements’ due to the inherent uncertainty therein.

For further information please visit the Xanadu Mines’ Website at www.xanadumines.com.

Kharmagtai JORC Table 1 (JORC 2012)

Set out below is Section 1 and Section 2 of Table 1 under the JORC Code, 2012 Edition for the Kharmagtai project. Data provided by Xanadu. This Table 1 updates the JORC Table 1 disclosure dated 18 September 2017.

JORC Table 1 - Section 1 – Sampling Techniques and Data

| Criteria | Commentary |

|

Sampling techniques |

|

|

Drilling techniques |

|

|

Drill sample recovery |

|

| Logging |

|

| Sub-sampling techniques and sample preparation |

|

|

Quality of assay data and laboratory tests |

|

|

Verification of sampling and assaying |

|

|

Location of data points |

|

|

Data spacing and distribution |

|

|

Orientation of data in relation to geological structure |

|

| Sample security |

|

| Audits or reviews |

|

JORC Table 1 – Section 2 – Reporting of Exploration Results

(Criteria in this section apply to all succeeding sections).

| Criteria | Commentary | ||||||||

| Mineral tenement and land tenure status |

|

||||||||

| Exploration done by other parties |

|

||||||||

| Geology |

|

||||||||

| Drill hole Information |

|

||||||||

| Timing | RC Holes | Metre | DDH Holes | Metre | RC & DDH | Metre | Trench | Metre | |

| Drilling <2015 | 155 | 24553 | 252 | 88511 | 0 | 0 | 106 | 39774 | |

| Drilling >2015 | 68 | 13107 | 116 | 57876 | 22 | 5323 | 17 | 5618 | |

| Total | 223 | 37660 | 368 | 146387 | 22 | 5323 | 123 | 45392 | |

| |||||||||

| Data aggregation methods |

Copper equivalent (CuEq or eCu) grade values were calculated using the following formula: eCu or CuEq = Cu + Au * 0.62097 * 0.8235, Gold Equivalent (eAu) grade values were calculated using the following formula: eAu = Au + Cu / 0.62097 * 0.8235. Where: Cu - copper grade (%) Au - gold grade (g/t) 0.62097 - conversion factor (gold to copper) 0.8235 - relative recovery of gold to copper (82.35%) The copper equivalent formula was based on the following parameters (prices are in USD): Copper price - 3.1 $/lb (or 6834 $/t) Gold price - 1320 $/oz Copper recovery - 85% Gold recovery - 70% Relative recovery of gold to copper = 70% / 85% = 82.35%. |

||||||||

| Relationship between mineralisation widths and intercept lengths |

|

||||||||

| Diagrams |

|

||||||||

| Balanced reporting |

|

||||||||

| Other substantive exploration data |

|

||||||||

| Further work |

|

||||||||

JORC Table 1 - Section 3 Estimation of Reporting of Mineral Resources

Mineral Resources are not reported so this is not applicable to this report.

JORC Table 1 - Section 4 Estimation and Reporting of Ore Reserves

Ore Reserves are not reported so this is not applicable to this report.

FIGURE 1:

Location of the Kharmagtai Project in the South Gobi porphyry copper belt.

FIGURE 2:

The Kharmagtai Mining Licence showing satellite imagery and location of the CSAMT survey lines. The lines labels in Yellow represent the lines seen in Figure 5.

FIGURE 3:

Long section through the high-grade Copper Hill deposit demonstrating the relationship between veins hosting the high-grade mineralisation and low angle structures. These b-veins are zoned symmetrically around Nanooks Fault strongly suggesting they formed during movement on that fault. Mapping this fault and others of similar orientation through the Mining lease becomes a critical tool for identifying and expanding high-grade mineralisation.

FIGURE 4:

Oblique view of the Kharmagtai Mining Licence showing processed CSAMT data in 3D.

FIGURE 5:

Selected CSAMT survey lines.

FIGURE 6:

3D model of part of the Kharmagtai lease showing the newly identified low angle structures. Note the majority of high-grade mineralisation is nested around these structures and that reactivation on these structures has jostled mineralisation slightly.

FIGURE 7:

Cross section through Golden Eagle, Zaraa and Stockwork Hill showing newly modelled structures and the locations of predicted extensions to high-grade zones.

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.