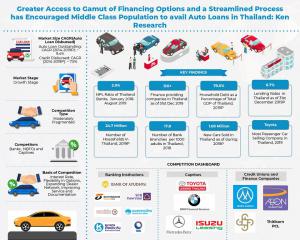

Thailand Auto Loan Outstanding is expected to reach around THB 4,500 Billion by 2024: Ken Research

Thailand Auto Finance Market Outlook to 2024 Growing Prominence of Captive Finance Companies and Loan Portfolio of Banks acting as a Catalyst for Market Growth.

THAILAND, January 21, 2020 /EINPresswire.com/ -- Thailand automotive industry is shifting focus towards electric vehicles (EVs), partly due to tightening regulations as tougher emission duty guidelines are set in major economies such as US, Europe, and China. In alignment with this wave, the Thai Finance Ministry reduced excise tax rates for EV cars since 2017, driving domestic sales of hybrid electric vehicles (HEVs), battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). This trend will likely to continue into 2019 despite the expected decline in the overall domestic automotive sales.Thailand's household debt rose to THB 12.8 trillion in last year's final quarter, up from THB 12.5 trillion registered in the third quarter, according to central bank data

Thailand's automotive industry expects cloudy sentiment in the next few months as it suffers from myriad negative factors such as restricted auto loan approvals from banks and an intense trade the war between the US and China, says the Federation of Thai Industries.

Growth Opportunity in Thailand EV market: High growth is projected in the EV segment of Thailand's automotive market will continue to support the industry. The Thai government is persistently trying to encourage the manufacturing of EVs and high-tech auto parts through the promotion of BOI incentive packages. In 2018, the government approved projects to produce HEVs and batteries by Nissan Motor Co and Honda Motor Co valued up to USD 888 million (THB 28 billion). Meanwhile, Mazda Motor Co was granted investment privilege to manufacture HEVs and has decided to apply for the production of full EVs in Thailand. Many other manufacturers also plan to invest and are studying for possible opportunities or are in the process of applying for the BOI package. EV segment still contributes very little to Thailand’s automotive market, but we can expect a ramp-up in production and an increase in adoption over the next few years.

Changing Nature of Ownership: Consumers in Thailand are increasingly moving forward to accommodate newer models of mobility and prefer partial ownership of vehicles instead of full ownership. Leasing and car rental were foreign concepts in Thailand a couple of years ago, however, they are now some of the growing operating models in the automobile industry in Thailand. This perception shift is forcing lenders to adopt new models and incorporate newer products in their portfolio offerings to consumers.

Analysts at Ken Research in their the latest publication “Thailand Auto Finance Market Outlook to 2024: Growing Prominence of Captive Finance Companies and Loan Portfolio of Banks acting as a Catalyst for Market Growth” believe that the market demand is likely to follow a growing trend in the near future due to a forthcoming increase in used cars sales and a shift towards newer models of mobility such as car-sharing and leasing, which will, in turn, help the economy grow as well. Some positive factors expected to impact the market are the influx of digitization based lending models (introduction of fin-tech products), the spread of customized loan products and a further rise in the penetration rate of banks and captive finance. The market is anticipated to register a positive CAGR of 8.8% in terms of credit disbursed and 10.2% in terms of total the loan outstanding during the forecasted period 2019P-2024F.

Key Segments Covered:-

By Vehicle Financed

New Vehicles

Used Vehicles

By Lender Institutions

Banks

Captives

Non Banking Finance Companies (NBFCs)

By Type of Finance

Passenger Vehicle

Commercial vehicles

Registration Pledge

Floor Plan

By Type of Vehicle

New Auto

Used Auto

Motorcycles

By Loan Tenure between New and Used Autos

One Year

Two Years

Three Years

Four Years

Five Years or more

Key Target Audience

Existing Auto Finance Companies

Banks

OEM Dealerships

Captive Finance Companies

Credit Unions

Private Finance Companies

New Market Entrants

Government Organizations

Investors

Auto mobile Associations

Auto mobile OEMs

Time Period Captured in the Report:

Historical Period: 2014-2019P

Forecast Period: 2019P-2024F

Key Companies Covered:

Banks

Thanachart Bank

Ayudhya Bank

Siam Commercial Bank

TISCO Bank

Kiatnakin Bank

Kasikorn Bank

ICBC Bank

Krungthai Bank

NBFCs

Muangthai Capital

Asia Sermkij Leasing

Nakhon Luang Capital Limited

Thitikorn

Summit Capital

Group Lease

Aeon Thana Sinsap

G Capital Public Limited

Thai Ace Capital

SGF Capital

JMT Network

Phatra Leasing Company

Mitsib Leasing

Captives

Toyota Leasing Thailand

Mercedes-Benz leasing

BMW Financial Services

MITSU Leasing Thailand

Ford Services Thailand Company Limited

Honda Leasing Thailand Company Limited

Hyundai Motor Thailand Company Limited

KIA Motors Finance

Mazda Financial Services Limited

Suzuki Motor Thailand Company Limited

Volvo Financial Services

Tri Petch Isuzu Leasing Company Limited

Land Rover Financial Services

Mini Financial Services

Porsche Financial services

Thai Rung Union Auto Public Company Limited

Key Topics Covered in the Report:-

Thailand Auto Finance Market Overview and Genesis

Thailand Auto Finance Market Ecosystem, 2019P

Value Chain Analysis of Thailand Auto Finance Market, 2019P

Thailand Finance Market Value Chain Analysis

Thailand Auto Finance Market Size, 2013-2019P

Thailand Auto Finance Market Segmentation, 20113-2019P

Major Trends and Development in Thailand Auto Finance Market

Issues and Challenges in Thailand Auto Finance Market

Regulatory Framework in the Thailand Auto Finance Market

Snapshot on Thailand Automotive Sales and Manufacturing Market, 2014-2019P

Ways to Finance Automotives in Thailand (Bank Finance or Multi Financing Companies, Personal Finance, Lease Financing)

Vendor Selection Process for Auto Finance Company in Thailand

Competitive Landscape Containing Company & Product Profiles in the Thailand Auto Finance Market

Financial Penetration of various OEM Brands

Thailand Finance Market Future Outlook and Projections, 2019P-2024

Analyst Recommendations for the Thailand Auto Finance Market

For More Information On The Research Report, Refer To Below Link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/thailand-auto-finance-market-outlook/299310-93.html

Related Reports by Ken Research:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/vietnam-auto-finance-market/180197-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/philippines-auto-finance-market-outlook/227542-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-car-finance-market-outlook/286575-93.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ankur Gupta

ken Research Private limited

+91 90153 78249

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.