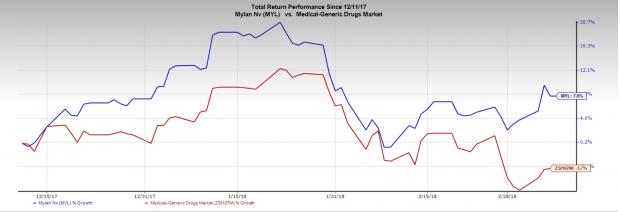

Shares of Mylan N.V. (NASDAQ:MYL) have gained 7.6% in the last three months, as against the industry’s decline of 3.7%.

Mylan’s fourth-quarter results were mixed with the bottom line exceeding expectations but the top line lagging the same due to weak EpiPen sales. The generic business in the United States continues to experience pricing pressure.

The year 2017 was challenging for Mylan given the ongoing pricing pressure in the United States and uncertain regulatory environment. Moreover, the company’s efforts to get Advair’s generic approved faced a jolt when the FDA issued a complete response letter to its abbreviated new drug application (ANDA) for generic Advair Diskus.

However, things are looking up for Mylan in 2018. We note that Mylan got a major boost with the FDA’s approval of a generic version of Teva Pharmaceuticals’ (NYSE:TEVA) Copaxone 40 mg. Notably, this is the first generic of Copaxone that has been approved. Since Mylan was one of the first applicants to submit a substantially complete ANDA for glatiramer acetate Injection, 40 mg/mL containing a Paragraph IV certification, the company and other first filers may be eligible for 180 days of generic drug exclusivity. The company also received an FDA approval for a biosimilar version of Roche Holdings’ (OTC:RHHBY) Herceptin.

Although volatility in the US markets is expected to persist in 2018, yet these approvals should position Mylan better in the year ahead and help it combat the decline in EpiPen sales. The company has more than 30 submissions planned in 2018. The launch of generic version of Estrace cream is also in the offing.

Meanwhile, key anticipated approvals include a biosimilar version of Neulasta with a target action date in June 2018. The company expects to launch the biosimilar in the second half assuming approval. The EMA has also accepted applications for both the biosimilars.

Meanwhile, Mylan and partner Momenta (NASDAQ:MNTA) announced that the companies will initiate a patient clinical trial of M710 — a proposed biosimilar of Eylea — in the first half of 2018. The trial will be a randomized, double-blind, active-control, multi-center study in patients with diabetic macular edema to compare the safety, efficacy and immunogenicity of M710 with the reference drug.

We note that Eylea, a vascular endothelial growth factor (VEGF) inhibitor, has been approved for the treatment of neovascular (wet) age-related macular degeneration, macular edema, following retinal vein occlusion, diabetic macular edema and diabetic retinopathy in patients with diabetic macular edema.

The company is also looking forward for a tentative approval of generic Restatis with a target action date in July 2018.

Zacks Rank

Mylan carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Momenta Pharmaceuticals, Inc. (MNTA): Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research