I recently noted that not only is the healthcare sector gaining momentum relative to the SPYs, but also that, because we're closer to the end of an expansion than the beginning, that we should consider moving into more defensive issues like healthcare and consumer staples.

With that in mind, I took a look at some of the largest publicly traded major drug companies and noticed that Pfizer is yielding a very healthy 3.79%. After digging into their financials, I found a very well-run company.

Pfizer (NYSE:PFE) is the second largest major drug manufacturer by market capitalization. Out of 28 competitors, they have the 9th highest PE and 16th highest forward PE. But these numbers are skewed; more than half of the major drug manufacturers have current or projected losses, giving them a current and forward PE of 0. Pfizer has raised their dividend consistently for the last eight years.

The major drug manufacturers have seen modest gains the last year:

The company has two divisions.

The company has two divisions.

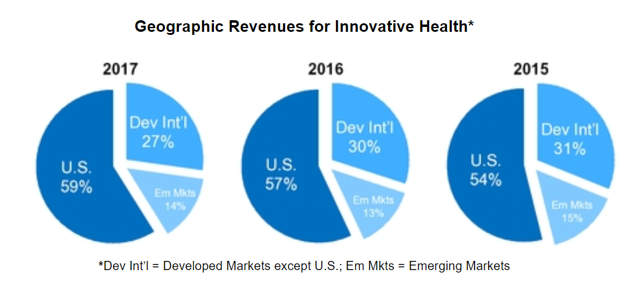

- Innovative health -- which is subdivided into six sub-groups -- is responsible for new drug development. It is responsible for 60% of Pfizer's revenue

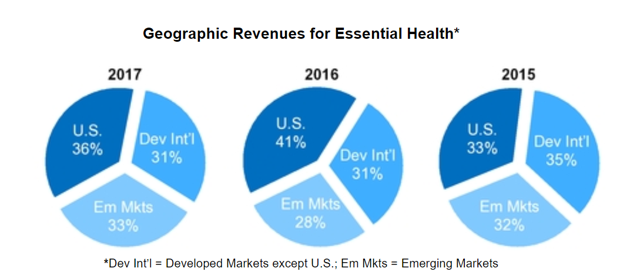

- Essential Health -- which is the home to drugs that whose patents have expired -- is responsible for the remaining 40% of the company's revenue.

They are truly international in scope:

The company has several methods of developing new drugs. First, they acquire attractive acquisitions targets. To that end, they have made the following major acquisitions since September 2015:

• On December 22, 2016, for $1,045 million we acquired the development and commercialization rights to AstraZeneca’s small molecule anti-infectives business, primarily outside the U.S., which includes the newly approved EU drug Zavicefta™ (ceftazidime-avibactam), the marketed agents Merrem™/Meronem™ (meropenem) and Zinforo™ (ceftaroline fosamil), and the clinical development assets aztreonam-avibactam and ceftaroline fosamil-avibactam.

• On September 28, 2016, we acquired Medivation for approximately $14.3 billion in cash ($13.9 billion, net of cash acquired). Medivation is a biopharmaceutical company focused on developing and commercializing small molecules for oncology.

• On June 24, 2016, we acquired Anacor for approximately $4.9 billion in cash ($4.5 billion net of cash acquired), plus $698 million debt assumed. Anacor is a biopharmaceutical company focused on novel small-molecule therapeutics derived from its boron chemistry platform.

• On September 3, 2015, we acquired Hospira, a leading provider of sterile injectable drugs and infusion technologies as well as a provider of biosimilars, for approximately $16.1 billion in cash ($15.7 billion, net of cash acquired).

They also have a broad pipeline of products under development internally:

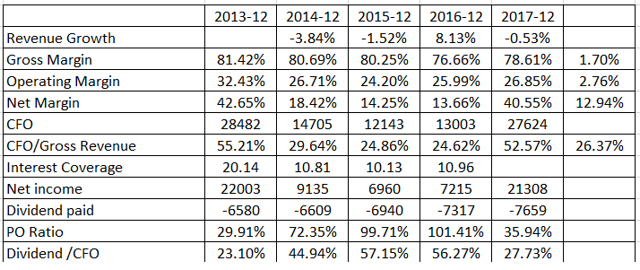

Let's take a look at some of their numbers (data from Morningstar.com; author's calculations)

With the exception of 2016, revenues are down. However, in two of those years, the topline decline was marginal. Their gross margin has been very steady; its standard deviation is 1.7 (the column on the right). Their operating margin has a higher standard deviation (2.76%) but that's due to the 32% reading in 2013; all other years have shown an operating margin in the mid-20s. Two events caused the large increases in the company's net margin. In 2013, they received a large boost of income from discontinued operations while this year they have a large injection from the tax package passed in December. I believe that the more realistic number is in the mid-20s; the column on the far right averages 2014, 2015, and 2016 to arrive at a 26.37% level.

About a quarter of their gross revenue is converted into cash flow from operations (NASDAQ:CFO). They have a very high interest coverage ratio; their dividend is safe (bottom two row).

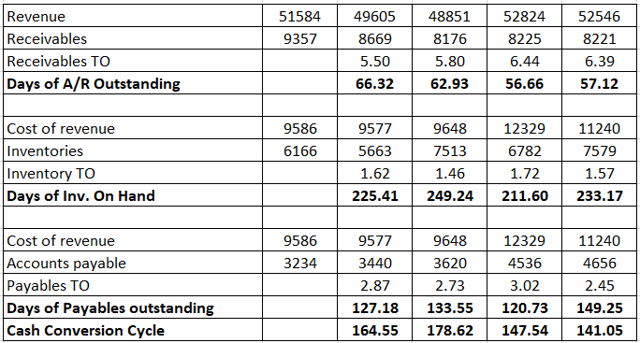

Let's turn to their activity and liquidity ratios:

The company has decreased their days of outstanding A/R. While there has been a modest uptick in their days of inventory on hand, they have also lengthed the days of payables outstanding. All of this adds up to a decline of 23.5 days in their cash conversion cycle, which, for a company this size, is pretty darn impressive.

The company has decreased their days of outstanding A/R. While there has been a modest uptick in their days of inventory on hand, they have also lengthed the days of payables outstanding. All of this adds up to a decline of 23.5 days in their cash conversion cycle, which, for a company this size, is pretty darn impressive.

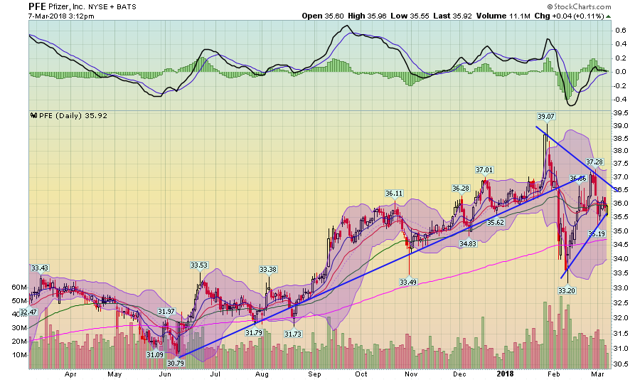

Finally, let's turn to their chart:

PFE broke their uptrend at the end of January. Now they are consolidating in a symmetrical triangle pattern. This is where the high yield comes into play; it helps to steady the stock price. However, there is more downside risk than I would like.

PFE broke their uptrend at the end of January. Now they are consolidating in a symmetrical triangle pattern. This is where the high yield comes into play; it helps to steady the stock price. However, there is more downside risk than I would like.

Pfizer is a well-run company. They've been adding new products via acquisition and internal research. They're in the right sector for the latter stages of the bull market. The chart shows a consolidating issue, that does, however, have a heightened downside risk.

This post is not an offer to buy or sell this security. It is also not specific investment advice for a recommendation for any specific person. Please see our disclaimer for additional information.