When US Sneezes, TCS Salary Freezes!

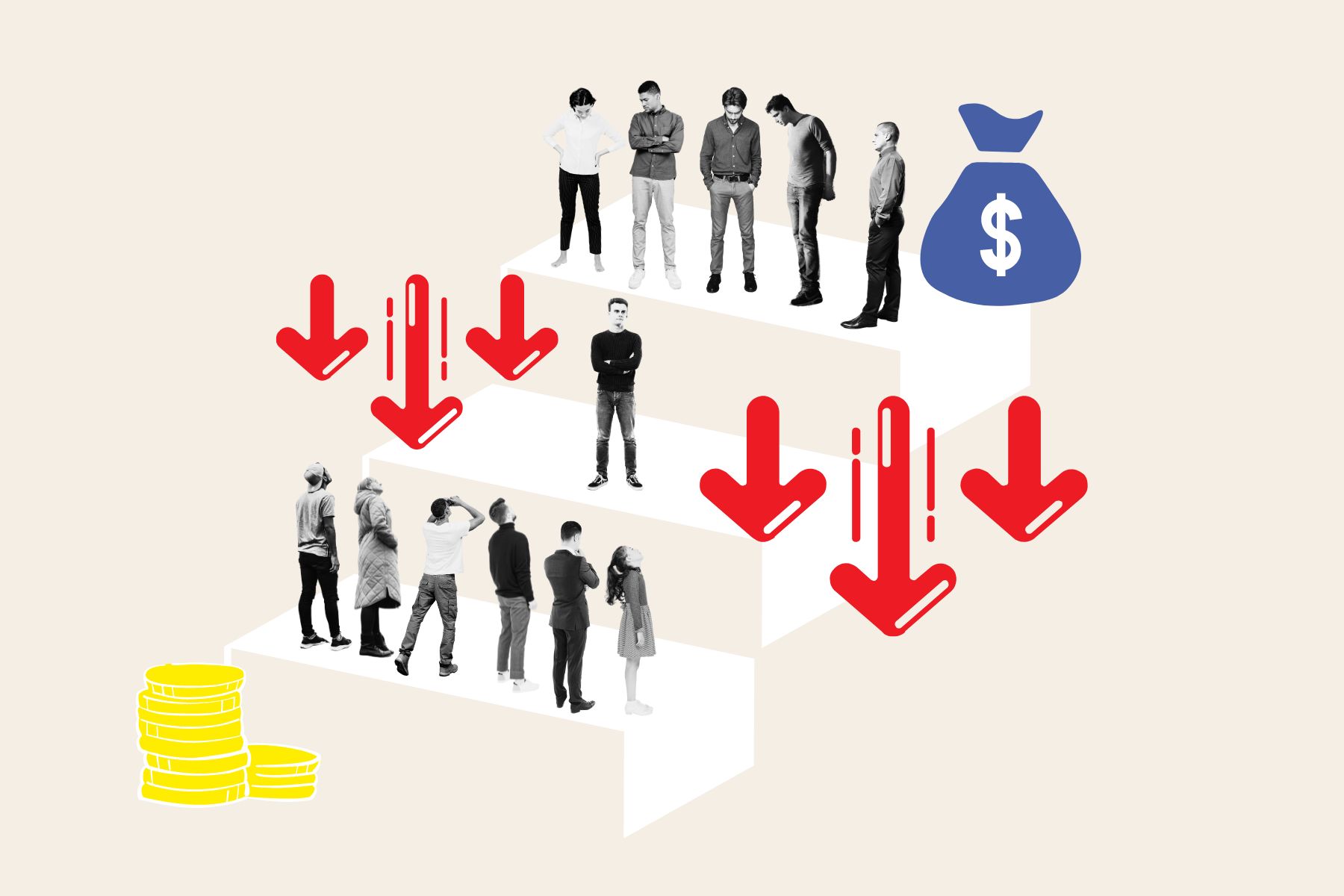

TCS Salary Freeze Reveals the Global Economic Domino Effect

Tata Consultancy Services (TCS), one of India’s leading IT players, said it would postpone its routine annual salary increases. The move comes in response to increased economic worries fueled by global trade tensions and market volatility. For a company with a staff of more than 600,000, the move is not merely about business; it reflects the performance of India’s IT sector and teaches us how integrated our global economy has become. If the US economy falters, India’s IT sector suffers as well as this has happened numerous times in the past.

TCS typically announces annual salary hikes in the first half of the financial year beginning in April. Now, they have brought this forward without a date. The company announced this on Thursday when they declared their fourth-quarter numbers for FY25. With 607,979 employees waiting for these annual hikes, the delay has triggered concerns over employee satisfaction and retaining employees in the sector. This is just the second time in recent times that TCS has taken such a move; the first being in 2020 with the pandemic uncertainty.

Q4 figures reflect cautious growth. TCS recorded a total profit after tax (PAT) of ₹12,224 crore, down 1.7% from ₹12,434 crore a year ago during the same quarter. Operating revenue stood at ₹64,479 crore, a 5.3% increase from ₹61,237 crore a year ago. The company reported an operating margin of 24.2% and a net margin of 19%; good numbers that still could not prevent the salary freeze announcement.

Reading Between the Lines: What TCS Leadership Is Saying

When questioned regarding the delay, TCS Chief HR Officer Milind Lakkad was careful with his words. He did not use the word “delay” or “deferment,” but employed it as a deliberate reaction to the business environment around. “We will monitor this environment on a daily, weekly, monthly basis and take a decision as to what is the first thing we need to do in terms of giving the wage hikes,” he replied, showing the company is opting for a wait-and-watch strategy and not a simple cancellation.

Lakkad added that this was not an easy decision: “The company does not want to do this at TCS, but due to the overall business issue, we felt it would be wise to do it this time.” The message is unmistakable as TCS is preparing for tougher times in the economy in the future.

Notably, while retaining the grip on fixed pay hikes, TCS will maintain its quarterly variable pay. In Q4, 70% of staff were paid their complete variable compensation, whereas the remaining 30% experienced adjustments in accordance with their individual business unit’s performance. This is a balanced strategy indicating a selective approach rather than blanket austerity.

On the recruitment side, TCS is positive, having added 2,000 more freshers than its target 40,000 in FY25. When queried if hiring still remains a good indicator of demand, Lakkad provided a philosophical perspective: “Hiring and demand are indeed related but not by every quarter. One should not compare hiring and demand for every quarter. TCS hires people upfront, trains them, and they get utilized in billable work in subsequent quarters.” This long-term talent hiring strategy suggests that though there are headwinds presently, TCS is positive about its growth trajectory in the long run.

The Ripple Effect: When America Sneezes, the Indian IT is catching cold!

The saying “When America sneezes, the world catches a cold” has been used in economic conversations for decades, and what is occurring at TCS demonstrates this phenomenon well. CEO K Krithivasan described how clients are not investing as much money in discretionary goods, and projects are being postponed because of issues with trade and politics. “If this continues, we could have more delays in IT budgets,” he warned.

This is not the first time that we have seen this trend. If we look at historical economic events, the 2008 global financial crisis showed us how rapidly economic problems can spread from the United States to India’s IT industry. Indian IT firms had project cancellations, billing rate compression, and recruitment freezes a few months after Lehman Brothers failed. This trend was again seen in the 2011-2012 European debt crisis and again in the 2020 COVID-19 pandemic.

Madhavi Arora, the Chief Economist at Emkay Global Financial Services, said the scenario is similar to “the chain reaction of deceleration in the globalized world, where one man is sneezing and everyone else is catching a cold.” She added that since TCS employs so many individuals, particularly in the middle-income groups, delayed wage hikes will impact their purchasing power and subsequently the Indian economy.

This pattern of economic changes has happened in other places, not just in the IT sector. In the Great Depression of the 1930s, American investment in colonial India dropped sharply, causing Indian textile exports to plummet. Again, in the oil crisis of the 1970s, when the US economy was struggling through slow growth and inflation, Indian foreign exchange reserves declined, causing serious economic readjustments.

Global Perspective: It’s Not Occurring Only in India

The TCS pay freeze is part of a larger trend of prudence visible across the globe outside India. Prudent actions along the same lines have been visible in tech firms across the globe. Other large tech firms like Microsoft, Google, and Amazon have recently announced layoffs or cut back on hiring, indicating a trend of greater prudence with expenditures due to uncertainty over the economy.

Japan’s past in the 1990s is a good example. Whenever there were economic recessions in the United States, Japanese export companies would typically be the first to halt raising wages and adding new employees. The same occurred in Southeast Asia in the 1997 Asian Financial Crisis. Singapore, Malaysian, and Thai companies did the same when US customers cut back on spending.

In recent times, even European IT consultancies like Capgemini and Accenture have also realized the health of the US economy. When US companies reduce their IT expenditure, European consultancies immediately experience pressure on their growth strategy and compensation policies. This indicates that when the US is facing issues, it influences not just India but also the technology sectors globally.

Sector-Specific Impacts: Who’s Most Vulnerable?

TCS leadership has identified certain industries that will be impacted the most by present economic issues, namely due to tariffs: Retail, Consumer Packaged Goods (CPG), Travel, and Automotive. These industries have largely been more economically volatile and trade-sensitive.

On a positive note, the Banking, Financial Services, and Insurance (BFSI) space, which accounts for over 30% of TCS’s revenues, is also relatively robust, apart from Insurance, which has its own issues. This shift in various sectors is a repeat of what has occurred earlier: in earlier economic downturns, additional IT expenditure in manufacturing and retail tended to fall first, while financial services tended to retain some technology investments due to regulations they had to adhere to.

Going back to the dot-com debacle of 2001, business-to-business companies serving the telecommunication and entertainment industries were hit the hardest, while in the 2008 financial crisis, financial services customers retreated most severely. Currently, the trend is pointing towards a more trade-war triggered recession with consumer-facing sectors taking the bulk of the uncertainty.

The Human Factor: Beyond Numbers

Behind the balance sheets and economic research are people whose lives are impacted by such business decisions. For most TCS employees, annual pay rises are not figures on a pay slip but core components of their budget. They are spent on housing loans, school bills, and pension contributions. A delay creates uncertainty that impacts families and communities.

In previous economic downturns, postponed wage increases in India’s IT industry have had some social implications; individuals postponing weddings, postponing purchasing homes, and cutting back on discretionary spending. These individual impacts eventually find their way into the overall economy, with effects like real estate markets and car sales.

The Indian story is not the only human story. In the technology capitals of the United States, Europe, and Asia, we have the same pattern when there is economic uncertainty. Silicon Valley went through a downturn in housing markets in the dot-com collapse, and Singapore’s shopping industry declined when banks withheld wages after the 2008 crisis.

Looking Ahead: Weathering Tough Times

Though there is prudence currently, TCS management is optimistic about FY26. They anticipate this year to be improved compared to FY25, particularly in global markets. This optimism, though with caution, indicates that the company is being prudent currently but is optimistic about the future. This approach has enabled TCS to weather previous economic downturns.

Sujan Hajra, Executive Director and Chief Economist, Anand Rathi Shares and Stock Brokers, presented a different perspective from the conventional wisdom: “TCS commentary indicates higher uncertainty and not a categorical call that growth in the world is slowing down.” He also clarified that even during a poor recession, the effect on business process outsourcing or IT spending might not be as worse: “As growth slows down, companies feel more urged to cut costs. So in this way, the chances of them going for increased utilization of outsourcing rise instead of decreasing.”

This view is consistent with history. In the 2008 financial crisis, while companies initially reduced their IT budgets, most later supplemented outsourcing to India to reduce costs. Likewise, the COVID-19 pandemic initially led to project delays, but later spurred digital transformation efforts, opening up new opportunities for IT service providers.

Industry-Wide Implications: Setting the Tone

TCS is the largest IT services company in India. Experts feel that its decision to freeze pay hikes will affect the industry at large. Infosys and Wipro, which are likely to announce their profits in the near future, may also do so.

Madhavi Arora described that “it is unlikely this wage hike delay would be only for TCS, as the entire IT industry is under stress.” Though the workers might look for a change in companies to get better salaries, the problems affect the whole sector, and that might limit other alternatives.

This trend of firms reacting to economic challenges is nothing novel. In the 2001 tech downturn, when one major Indian IT company declared that it would stop hiring, the others quickly followed within a few days. Likewise, in the 2008 crisis, delayed pay hikes swept the industry in a few weeks of the first announcement.

Analysts also expect potential margin squeeze on companies if attrition picks up due to the lack of salary hikes. For TCS, attrition has already risen modestly to 13.3% from 13% quarter-on-quarter. However, the company is still adding to its manpower, recruiting a net 6,433 individuals in the previous quarter, a sign that although there is prudence, full retrenchment is not planned.

The Bigger Picture: Economic Interconnectedness

The TCS pay freeze shows how interconnected the world economy has become as a result of a few decades of globalization. When American consumers buy fewer goods because they are worried about inflation, retailers order fewer goods. This cuts back on spending on IT for supply chain and inventory management. The effect can be felt far away in Bangalore or Hyderabad, where project teams have fewer billable hours and companies postpone salary increases.

This chain of events, however, does not end with India and America. The same trends are evident between China and Australia (in which Chinese economy directly influences Australian mining exports), Germany and Eastern Europe (in which German car manufacturing production schedules control Eastern European parts manufacturers), and Japan and Thailand (in which Japanese electronics demand influences Thai manufacturing production).

Conclusion: Navigating Uncertainty with Resilience

TCS is optimistic on long-term growth, but postponing salary hikes indicates the short-term issues in India’s IT industry. As long as economic pressures are not easing rapidly, employees may need to prepare for a longer period of pinched spending—at least until the global markets stabilize once more.

While the industry holds its breath for Infosys and Wipro’s quarterly numbers, the larger question is: Is TCS’s cautiousness the exception or the new normal in the industry? History would indicate that the latter is more probable, with the same trends repeated across different economic cycles.

For Indian IT employees, businesses, and the economy as a whole, this period exhibits weakness as well as strength. Although world economic issues continue to impact Indian IT, the sector has demonstrated its ability to adapt, expand, and improve after every financial hurdle. The current scenario is alarming but is merely another chapter in the tale of how economies are interdependent. This tale will likely witness businesses such as TCS weathering difficult times and preparing for the next phase of expansion once the economy picks up.

As the old Wall Street maxim goes, “The time to buy is when there’s blood in the streets”, or in the case of IT services, perhaps, “The time to invest is when there’s a salary freeze in Bangalore.” For those with patience, today’s prudence may be laying the groundwork for tomorrow’s expansion.