ASX gains, as employment drops and May rate cut remains likely — as it happened

The Australian share market gained strongly today on hopes for two more US rate cuts this year, and weaker jobs numbers kept a May rate cut as the next likely move for the RBA.

Here's how the trading day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +1.2% at 7,919 points

- Australian dollar: -0.3% at 63.36 US cents

- Nikkei: -0.3% to 37,752 points

- Hang Seng: -1.4% to 24,415 points

- Shanghai: -0.3% to 3,418 points

- S&P 500: +1.1% to 5,675 points

- Dow Jones: +0.9% to 41,964 points.

- Nasdaq: +1.4% to 17,750 points

- FTSE: Flat at 8,706 points

- EuroStoxx: +0.2% to 555 points

- Spot gold: Flat at $US3,046/ounce

- Brent crude: +0.5% to $US71.13/barrel

- Iron ore: Flat at $US102.00 a tonne

- Bitcoin: +0.7% to $US85,968

Prices current around 5:16pm AEDT.

Updates on the major ASX indices:

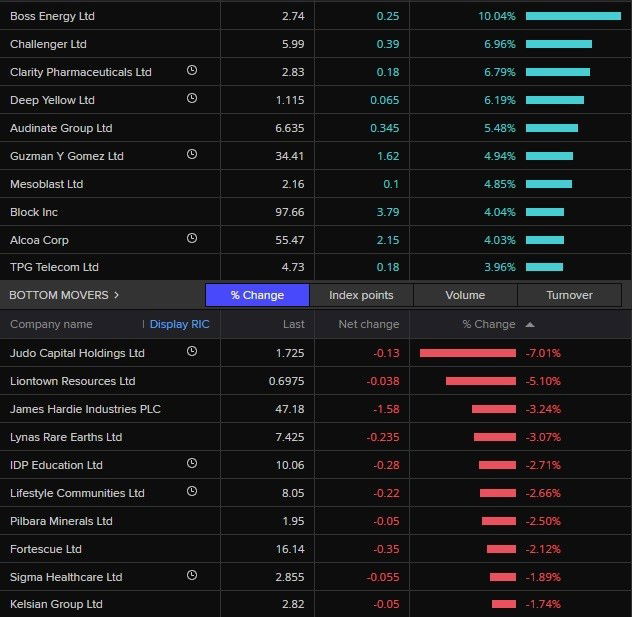

ASX climbs strongly as banks lead

Strong gains for the technology (2.1%), industrials (2%), real estate (2%) and financials (1.9%) sectors pulled the Australian share market higher.

The heavyweight big four banks plus Macquarie were the driving forces, due to their sheer size.

Australia's biggest investment bank jumped 3.8% to $201.79, while the largest retail bank — CBA — was up 2.2% to $145.93.

The other major banks had more modest gains between 1.4-1.6%.

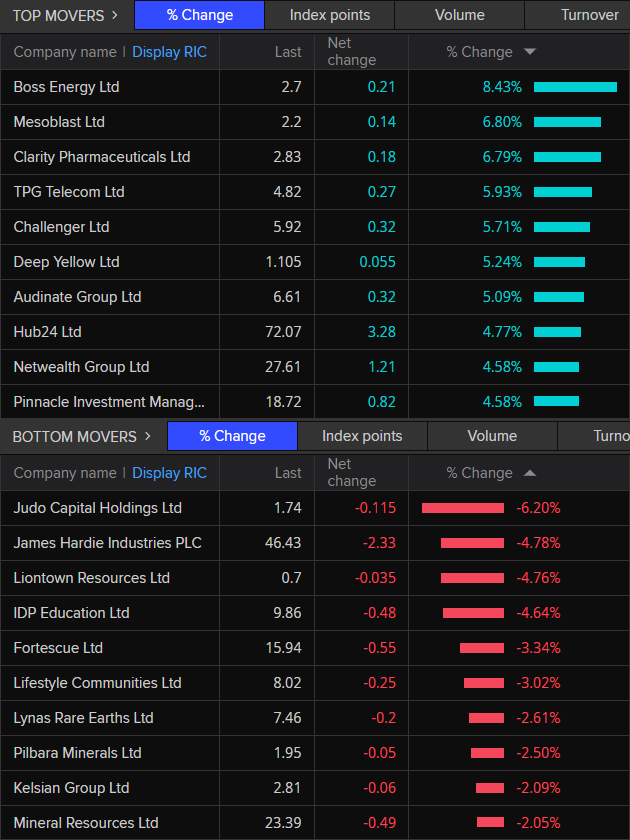

One financial firm going the other way was business-focused Judo Bank, whose parent Judo Capital Holdings dropped 6.2% to $1.74 after two major shareholders sold down their stakes to the tune of $191.4 million.

The big miners also capped gains for the major indices, with BHP and Rio Tinto both down just over 1%, while Fortescue lost 3.3%.

Overall, the ASX 200 was 1.2% higher by the close at 7,919 points.

The Australian dollar was worth 63.35 US cents, down about a third of a per cent.

And that's all for today's market action.

LoadingParticipation should decline as population ages

Will the aging population have a long term negative affect on employment?

- Sophie

Hi Sophie, that's a great question.

The participation rate should decline as the population ages — hence all those Intergenerational Report warnings about fewer working age people having to pay more taxes to look after the pensions, health care and aged care needs of retired Baby Boomers.

I actually wrote something years ago about participation peaking at 66% in 2010, which turned out to be hopelessly wrong as participation has kept hitting hit fresh records since (like January 2025's rate of 67.2%).

Or maybe I wasn't hopelessly wrong, just way too early with the call?

The cost-of-living crisis certainly seems to have keep a lot more older Australians in the workforce longer, along with a lot of potential second income earners (mainly women).

This was the article I wrote in 2012.

Unemployment would have surged to 4.7 per cent without participation slump

Highlighting how significant the large plunge in the participation rate is in today's February jobs numbers, KPMG's chief economist Brendan Rynne says the unemployment rate would have jumped from 4.1% to 4.7% without it.

The saving grace is that participation plunged from a record high of 67.2% in January to 66.8%, which is still 0.1 percentage point higher than it was a year ago.

Also heartening is that many of those leaving the jobs market seem to be doing so for good reasons, not simply because they are struggling to find any work.

The ABS noted that an unusually large number of older Australians failed to return to the workforce in February, having retired at the end of last year.

Brendan Rynne also noted that a 0.6 percentage point slump in female participation to 62.8% largely just reversed a 0.5 percentage point rise in January.

He believes it may have something to do with easing cost-of-living pressures.

"It seems there is a pool of women who — with household budgets under pressure due to cost of living increases — were on the verge of looking for work (switching between unemployed and not in the labour force) over the past 3-6 months," he wrote.

"It is possible that a combination of the stage 3 tax cuts, the February interest rate cut and some wages growth in partner incomes have done enough to ease household budgets and pull them back from looking for work.

"We do seem to be seeing a plateauing of the female participation rate."

Federal budget an 'upside risk' to inflation and rate cuts, UBS says

This note just in from the firm about today's jobs data, which shows unemployment stuck to 4.1 per cent in February, but that there was still a huge number dropping out of the workforce.

UBS says:

The labour market data is often very volatile, and Feb-25 has unusual revisions and seemingly seasonal issues. Overall, the labour market is probably easing, but remains tighter than 'full employment', & stronger than during prior RBA rate cut cycles. UBS still expect the next RBA rate cut of -25bps in May-25; but require Q1-25 CPI to show ongoing moderation of inflation. The Australian Government budget is an upside risk.

Greenpeace to pay $1b fine over oil and gas protests

This news out of the States.

Greenpeace must pay more than $USD660 million ($1 billion) in damages for defamation and other claims brought by a company over protests against the construction of the Dakota Access oil pipeline in North Dakota, a jury has found.

The environmental group said earlier that a large award to Dallas-based Energy Transfer and subsidiary Dakota Access would threaten to bankrupt the organisation.

The oil pipeline company accused three different arms of Greenpeace of defamation, trespass, nuisance, civil conspiracy and other acts.

Greenpeace USA was found liable for all counts, while the others were found liable for some.

Why homeowners are making record profits reselling property

I spoke to CoreLogic's Eliza Owen about their latest round of data, which shows homeowners are making a record amount of cash selling property, around $306,000.

The data also shows, however, there is a small section taking a loss and evidence that is with some mortgage holders hitting a rate cliff.

Why solar batteries are making more sense for households

This story from Rhiana Whitson.

Update

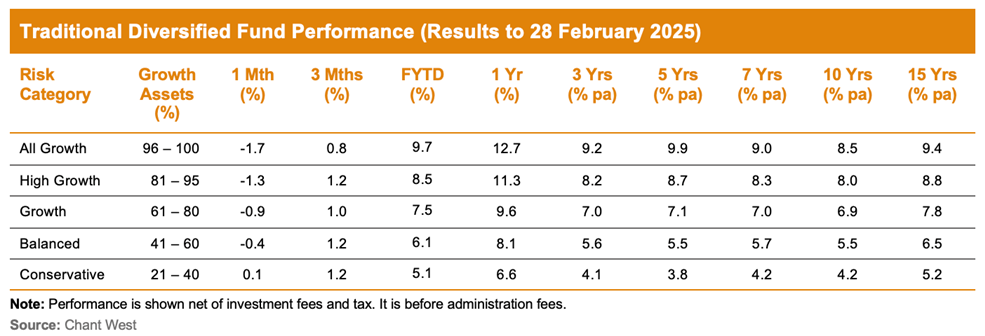

Has anyone checked their super balance ? I`m a 73yr old retiree , Jan 30/25 $360k , March 18/25 $ 342 k !! Riding it out is the advice ......Thank you Mr Trump

- Tony

Hi Tony,

You are most certainly not alone in having a falling super balance last month.

Chant West, a research house that monitors super, found the median "growth fund", which is the type of fund most of us are in, was down 0.9% last month.

"Over the month, Australian shares were down 3.8%," observed Chant West senior investment research manager Mano Mohankumar.

"Developed market international shares were down 0.9% and 0.4% in [currency] hedged and unhedged terms respectively, led by the falls in the US market.

"Emerging markets shares fared better, returning 0.8%.

"Over the same period, bonds played their traditional diversifier role with Australian and international bonds returning 0.9% and 1.2% respectively, as bond yields fell."

You can see in the below table, that more conservative investment allocations with a heavier weight towards cash and bonds performed less poorly.

But Mr Mohankumar said members need to remember that their super fund portfolios have previously weathered periods of market volatility.

"Most Australians have their super invested in well diversified portfolios with their exposure spread across a wide range of growth-orientated and defensive asset classes," he wrote.

"That diversification helps limit the damage during periods of share market weakness as we saw in February and March to date.

"However, with 55% still allocated to listed share markets, growth funds are able to capture a meaningful proportion of the upside when those markets perform strongly, as we saw in each of the past two calendar years when the median growth fund returned 9.9% and 13.4% in calendar year (CY) '23 and CY24, respectively.

"It's important to see things in context."

ASX 200 trading 1.3% higher in afternoon trade

Aussie investors are in a good mood.

Here's the top and bottom stocks on the main index.

Any you'd like looked at more closely?

How helping women into work is worth millions to economy

Helping women into the workforce is worth millions to the economy, a study of charity Fitted for Work has found.

The not-for-profit has assisted 45,000 women and gender-diverse individuals over the past two decades, through workshops, mentoring and outfit services.

Analysis has found Fitted for Work cuts down the amount of time spent securing work to 26 weeks, or half the national average.

The study by economic research firm Mandala found for every $1 invested, there is an immediate economic return of $2.19, totalling $86 million in net direct economic benefits over the past 20 years.

Among the job seekers who have been assisted is Mariana, who spent six years looking for a permanent marketing role and started a new job last week.

Other organisations, such as Dress for Success and Ready Set, also help people into employment with similar assistance.

Increasing women's workforce participation is worth a lot to the economy, with research from the Women's Economic Equality Taskforce finding it could boost the economy by $128 billion.

Here's the story from business reporter Emily Stewart:

70 per cent of market betting on a rate cut in May

Looks like the job losses in the latest unemployment figures have had a little impact on the market's rate cut bets.

The RBA takes the labour market into consideration when deciding whether to set interest rates.

Just shy of 10% of the market is betting on a rate cut in April, but a whopping 70% reckon it'll happen in May.

The cash rate is currently at 4.1 per cent after that quarter of a per cent cut in February.

The RBA next meets on April 1. (April Fools rate cut?)

Then it meets on May 20.

As we know from recent comments from the RBA's Sarah Hunter, the RBA generally thinks that market bets a bit higher than the likelihood.

Is the February fall in employment mainly statistical noise?

A 52,800 fall in employment, like we saw in the ABS figures for February, is unusually large.

Because the jobs data are based on a survey — albeit one of the nation's biggest — they are prone to some statistical error as the sample changes over time.

The headline figures are also seasonally adjusted, and dramatic shifts in our social, consumption and working habits can be slow to show up in changes to that seasonal adjustment.

We've seen that with the trend towards Black Friday shopping in recent years for the retail sales data.

We have also seen it in the employment data, with more people deciding to take an extended break over summer before starting a new job, which has caused some big fluctuations.

It now seems a sudden wave of retirements at the end of last year has caused volatility.

But JP Morgan economist Tom Kennedy believes that will sort itself out over the next few months.

"The labour participation rate shows a slow-moving but consistent trend with the absolute monthly change averaging 0.2%pts since the late 1970s," he noted.

"Today's outcome is therefore unusual and about 2 standard deviations larger than normal.

"Historically, moves of this magnitude are unwound in subsequent months (for example, December 2023) so we are inclined to fade February's print, particularly given our prior research which flagged the greater potential for volatility in labour supply early in the year."

Either that, or with inflation starting to come down, more older Australians who'd been hanging on to their jobs for a bit longer decided it was finally safe enough to quit the workforce.

Let us know what you think about that theory in the comments.

Seasonal return to work affecting unemployment figures

January's jobs data, where unemployment was at 4.1 per cent, was impacted by Australians waiting to return to work or start new roles after the summer break.

Economists have observed seasonal effects still playing out in February, where the rate is also still at 4.1 per cent.

"We wouldn't be surprised if the sharp fall in employment last month is revised to a smaller one over the coming months," Capital Economics head of Asia-Pacific Marcel Thieliant wrote.

Betashares chief economist David Bassanese said the "apparent steep fall in employment during February needs to be taken with a grain of salt", pointing to "turn-of-the-year seasonal adjustment problems" since the pandemic.

The ABS said there were higher levels of retirement in Australia in recent month, and that it would release more detailed data on the trend next week.

Read more here.

Vocus group to become underground fibre giant after ACCC approves merger

Macquarie-backed fibre network Vocus Group is about to emerge as one of Australia's largest owners of underground fibre infrastructure.

That is after the competition regulator approved its $5.25 billion deal with TPG Telecom.

Vocus and TPG agreed to a deal last October, for the former to take over the telecom operator's fibre and fixed network infrastructure assets, enabling Vocus to connect almost 20,000 buildings in Australia.

The Australian Competition and Consumer Commission (ACCC) said the deal would not likely result in a substantial reduction of competition in any market.

The ACCC's review focused on how closely Vocus and TPG compete in the supply of data network and connectivity services, including fixed-line internet services, to large enterprise and government customers, it said in a statement.

The ACCC said that Vocus would continue to face major competition from other sectoral firms — including Telstra , Singtel-owned Optus, and other local players such as Superloop and Aussie Broadband.

The watchdog's probe further found that Vocus focuses on providing services to large enterprise and government clients while TPG concentrates on the small and medium enterprise segment of the market.

Shares in TPG gained over 5% in Sydney to $4.78. Its biggest rival, Telstra, was trading 0.7% higher.

A Macquarie-managed infrastructure fund, alongside Aware Super, acquired Vocus in 2021, taking the company private and delisting it from the Australian exchange.

Macquarie has since strengthened its position, with Dutch pension fund APG acquiring a 10% interest in Vocus.

The move reduced Aware's holding while leaving Macquarie's stake unchanged, firmly positioning the asset manager in the driver's seat.

Vocus did not respond to a Reuters request for comment.

Is the labour more "still tight" or getting weaker?

Adelaide Timbrell’s view that the labour market is “still tight” is objectively false. We need only look at not just today’s figures from the ABS, but also the recent data from Roy Morgan showing sharply rising unemployment, as well as recent ABS and Seek data showing plunging job vacancies. Taking a combined view of all these data points, there is no reasonable justification for claiming that the labour market is strong. It is at best balanced right now, and rather quickly transitioning to a weak labour market.

- Eric

Thanks for your comments! Nice to have some healthy debate.

Worth noting Treasurer Jim Chalmers just put out a statement, also saying unemployment is still "really low" but experiencing some "expected softening" (economics talk for less people in work).

Tell us about mergers, competition watchdog asks

Hi team,

Just jumping in with news of a hobbyhorse of mine, merger reform!

(In case you think it doesn't affect you, it does! Australia's 27.5 million people live and work in an economy that is dominated - in many sectors - by just one or two big players).

Add in our geographical span (immense) and our relatively small population and that concentration has big impact.

The Australian Competition and Consumer Commission (ACCC) it pushing along the steps of its new "merger regime" with the release of a guidelines for consultation.

This is the analytical framework the watchdog will use assessing mergers that it is told about - and the "best practice" for assessing competition in different fields.

The new regime won't kick in until 1 January 2026 but these guidelines provide an early look.

Here's ACCC Commissioner Dr Philip Williams:

“The merger assessment guidelines are intended to help the community, including merger parties and their advisers, understand how the ACCC will assess acquisitions under the new regime.”

“This combined with the increased transparency that will be available for all decisions and the reasons for the decisions, will provide greater predictability regarding the ACCC’s analysis and decision making.”

One of the big changes will be that the ACCC's decisions will have a lot more details - not just about the decision on a particular case, but on the institution's view of that market.

“While the ‘substantial lessening of competition’ legal test has not changed, the legislation has clarified that it does include creating, strengthening or entrenching a substantial degree of market power. This reflects the economic link between a lessening of competition and an increase in market power, which is recognised in the jurisprudence and supports the approach to merger assessment set out in the guidelines."

Jurisprudence is the theory or study of law. Dr Williams appears to be saying the theory is that if you take out competition those remaining increase in power - which makes sense.

“Another change is that the cumulative effect on competition resulting from serial acquisitions over the preceding three years can now be taken into account in the ACCC’s decision on whether to approve an acquisition.”

Another important element - decisions made in context of broader market dynamics.

in any case, the ACCC is seeking feedback from businesses, consumers and other "interested members of the community" until 17 April 2025.

You can find out more here.

Population growth continues slowing in September quarter

Australia's population grew by 1.8 per cent in the 12 months to 30 September 2024, according to data out today from the Australian Bureau of Statistics (ABS).

"Our population at 30 September 2024 was 27.3 million people, that's 484,000 more people since the same time in 2023," said Beidar Cho, the ABS head of demography.

"There were 617,900 people arriving from overseas and 238,100 departures.

"This means that 379,800 people were added to our population from overseas migration for the year to 30 September 2024, continuing a downward trend in recent quarters."

Natural increase (births minus deaths) added 104,200 people, down 3 per cent from the previous year.

The data show there were 291,200 births and 187,000 deaths registered over the period.

Treasurer says jobs data shows labour market is 'softening'

This statement in from Jim Chalmers about the latest unemployment figure, which stayed at 4.1 per cent in February, despite 53,000 less people being employed.

Today's data shows some of the expected softening in the labour market, but unemployment is still really low at 4.1 per cent.

While there are still challenges in our economy and people are still under pressure, we still have the lowest average unemployment of any government in the last 50 years.

Low unemployment and much lower inflation is a remarkable combination when you look at our historical experience and what’s happening in other countries.

Unemployment currently sitting below RBA forecasts

The Reserve Bank's latest forecasts, released last month, are for the unemployment rate to average 4.2 per cent by mid-year, and remain around that level over the next few years.

It's still at 4.1 per cent for February.

As we know with the RBA, and the divisive NAIRU theory, there are targets to have unemployment at a certain level to theoretically keep inflation down.

More in this piece from my colleague, Steph Chalmers.