India: In the World’s Most Populous Country, Health is Putting Plants on the Plate

6 Mins Read

A nation known for its meat-free culture, India’s plant-based food market is on the “brink of transformation” as healthy eating and protein intake take centre stage.

While many have spelt doom on the vegan food industry, its most populous nation is getting hungrier for plants.

India’s plant-based sector grew by 18% in the last three years, reaching ₹300 crores ($36M) in 2024. While this is still in its infancy compared to the more developed markets in other countries, and makes up less than 0.1% of the domestic animal protein sector, it’s catching up fast.

Over the next decade, vegan proteins in India are “set to be woven into everyday meals and snacks, attracting a wider audience beyond vegans”, according to a new report by market research firm Ipsos. By 2034, the market could be valued at ₹5,500 crores ($690M), an 18-fold increase.

This is thanks to rampant urbanisation, rising disposable incomes, e-commerce growth, and greater health consciousness, built upon a culture rooted in meat-free eating and where awareness of lactose intolerance and dairy industry harms is more prominent.

Still, several challenges persist, from the taste and price gap for plant proteins to cold supply chain issues and a lack of VC interest.

“Most startups are bootstrapped,” noted Abhishek Sinha, co-founder of meat alternative startup GoodDot, which has raised $7M, mostly for its production infrastructure. “A lot more capital is required to drive the necessary education and awareness in this industry. Thus, we are utilising innovative and capital-efficient methods to drive awareness.”

The industry, however, is rapidly evolving, driven by “innovation and strong interest from businesses, investors, and policymakers”, according to Praveer Srivastava, executive director of the Plant Based Foods Industry Association (PBFIA), which co-published the report. “India, with its deep-rooted traditions in plant-based diets, is uniquely positioned to lead this shift,” he said.

Dairy the leading plant-based growth driver in India

Ipsos’s analysis found that leading plant-based dairy players posted over 20% growth in 2024, spearheading the sector’s growth. Plant-based protein and meat leaders experienced either single-digit hikes, or declines.

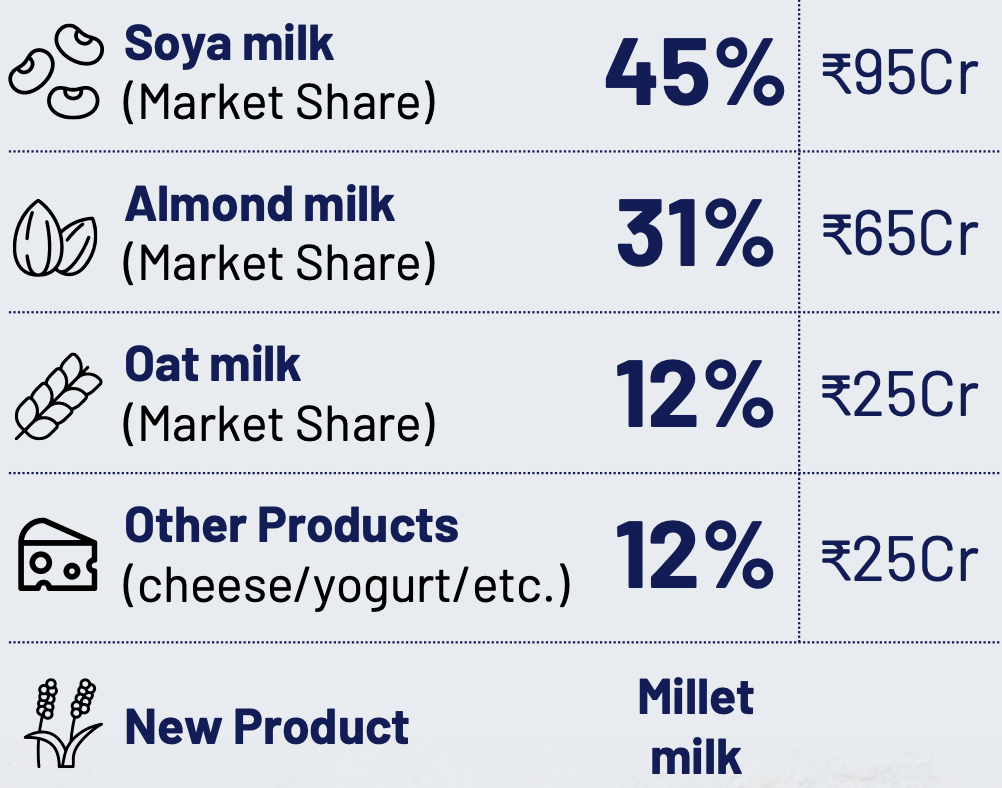

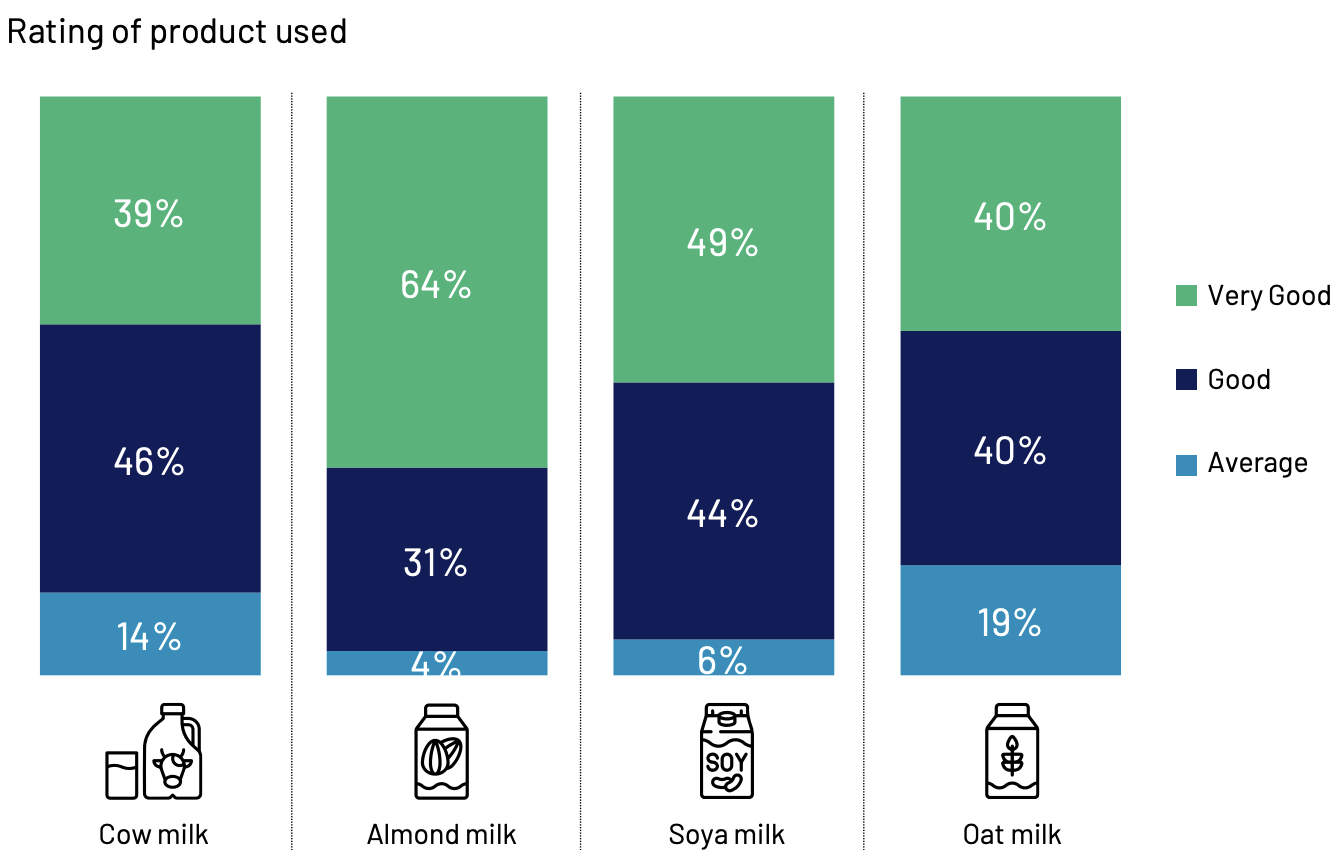

Soy milk seems to be Indians’ favourite non-dairy alternative (with a 45% share), followed by almond milk (31%) and oat milk (12%) – the latter, however, is gaining traction quickly. However, 64% of almond milk drinkers find it ‘very good’, compared to 49% who say the same for soy milk, and 40% for oat milk.

Plant-based milk has also been embraced by the hospitality industry, with most major coffee chains and scores of independent shops offering these products (usually at a charge). They’re most popular for at-home though, with retail making up 80% of the market. In fact, unlike in Western countries, half of all plant-based milk is bought online in India.

Further accentuating the dairy dominance, nearly half (49%) of Indian households are familiar with plant-based milk, and almost a quarter (23%) have tried it. In contrast, only 28% know about meat alternatives, and one in 10 have actually tried these proteins.

“Of the households who have tried plant-based dairy, 10% of them have also purchased plant-based meat. This indicates that plant-based dairy is the strongest entry point into the consumer’s household,” the report states.

Consumers show an appetite for plants over animals

Despite the above, only 7-8% of Indians drink plant-based milk every day, according to polling by Ipsos. Interest in these products is driven by health, with a third of consumer valuing their nutritional credentials, and 11% choosing them due to lactose intolerance. Only 9% pick them for their taste, highlighting the flavour gap companies need to fill.

Additionally, 37% of consumers say milk alternatives are too expensive, and 35% can’t find it easily. This isn’t restricted to just dairy, though – about a third of Indians have the same problems with meat analogues. There’s a feeling that these products aren’t needed, unless they tend to a health problem.

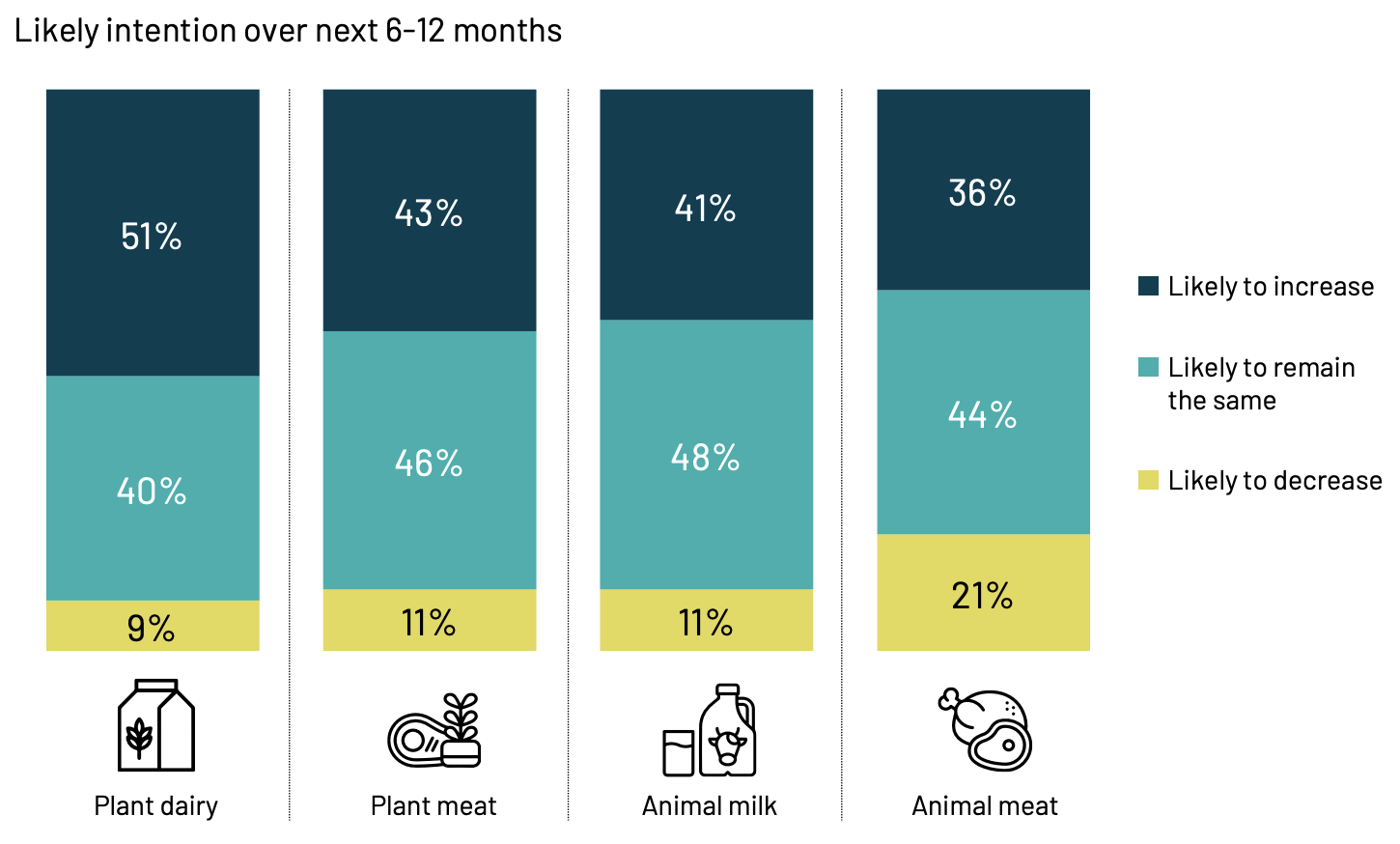

That being said, in an encouraging finding for the industry, more people want to increase their consumption of plant-based over animal proteins. In the next six to 12 months, 51% of Indians say they’re likely to drink more non-dairy milk, versus 41% who will increase their cow’s milk intake.

Similarly, 43% want to eat more plant-based meat, a share that only reaches 36% for conventional meat. Moreover, two in five Indians (21%) are looking to cut back on animal meat, and 11% want to do the same for dairy, versus the 11% and 9% who want to reduce vegan meat and milk consumption, respectively.

This has left India’s alternative protein ecosystem “on the brink of transformation”, complemented by more awareness around lactose intolerance (which 60% of Indians suffer from) and a concerted effort to eat more protein. Research suggests that 80% of the adult population in India is protein-deficient, although some argue there’s more than meets the eye.

To capitalise on this shift, companies are prioritising protein-rich plant-based foods over meat analogues, expanding into the ambient category to drive growth in tier 1 and 2 cities and the export market, doubling down on product innovation for barista milk and localised ingredients, and offering clean-label products.

Government support critical for vegan sector

Ipsos says India could become a leading export hub for plant protein concentrates, isolates, and alternatives. However, government support is crucial here.

The report recommends launching a National Plant Protein Mission to scale the sector through infrastructure development and investment incentives, and building a plant protein cluster to facilitate collaboration and speed up commercialisation.

In addition, policymakers must level the playing field for plant proteins, which face “regulatory and tax-related disadvantages” – for example, plant-based foods have a much higher VAT (18%) than animal proteins (5%), while terms like ‘milk’ and even ‘mylk’ are barred from vegan product labels.

Plus, the industry would benefit from a dedicated policy framework for plant-based foods, under the Ministry of Food Processing Industries. These products should further be integrated into the Priority Sector Lending guidelines to enable easier credit access for startups and manufacturers.

Finally, industry players need to ramp up collaborations with restaurants, caterers, and airlines; improve their pricing and explore smaller pack sizes; double down on health messaging; and offer promotions on vegetarian-focused festivals like Navratri and Shravan.

“The burgeoning interest in health and wellness, coupled with increasing awareness of lactose intolerance and protein deficiency, further fuels the demand for plant-based alternatives,” said Deepak H, India head at Ipsos Strategy3. “By fostering innovation, ensuring affordability, and promoting greater awareness, India can unlock the full potential of its plant-based foods sector.”