Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s analyze whether Fresh Del Monte Produce Inc (NYSE:FDP) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

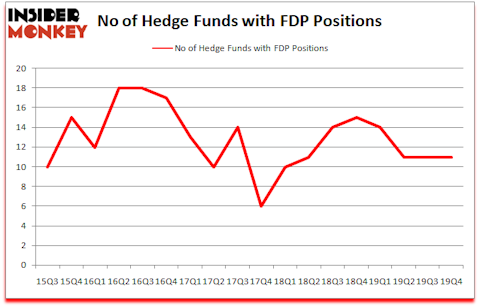

Hedge fund interest in Fresh Del Monte Produce Inc (NYSE:FDP) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Hailiang Education Group Inc. (NASDAQ:HLG), Rush Enterprises, Inc. (NASDAQ:RUSHA), and Ballard Power Systems Inc. (NASDAQ:BLDP) to gather more data points. Our calculations also showed that FDP isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

If you’d ask most market participants, hedge funds are viewed as slow, old investment tools of yesteryear. While there are more than 8000 funds with their doors open at present, We choose to focus on the masters of this group, around 850 funds. These hedge fund managers preside over bulk of the smart money’s total capital, and by shadowing their first-class investments, Insider Monkey has unsheathed various investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Ken Griffin of Citadel Investment Group

We leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve and other Central Banks are tripping over each other to print more money. As a result, we believe gold stocks will outperform fixed income ETFs in the long-term. So we are checking out investment opportunities like this one. We consider innovative alternative investment ideas like this one offered by Masterworks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to take a peek at the new hedge fund action surrounding Fresh Del Monte Produce Inc (NYSE:FDP).

How have hedgies been trading Fresh Del Monte Produce Inc (NYSE:FDP)?

Heading into the first quarter of 2020, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards FDP over the last 18 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies has the largest position in Fresh Del Monte Produce Inc (NYSE:FDP), worth close to $26.7 million, comprising less than 0.1%% of its total 13F portfolio. On Renaissance Technologies’s heels is Royce & Associates, led by Chuck Royce, holding a $6.6 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish comprise Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, Ken Griffin’s Citadel Investment Group and Ali Motamed’s Invenomic Capital Management. In terms of the portfolio weights assigned to each position Algert Coldiron Investors allocated the biggest weight to Fresh Del Monte Produce Inc (NYSE:FDP), around 0.92% of its 13F portfolio. Invenomic Capital Management is also relatively very bullish on the stock, dishing out 0.64 percent of its 13F equity portfolio to FDP.

Seeing as Fresh Del Monte Produce Inc (NYSE:FDP) has experienced bearish sentiment from hedge fund managers, it’s safe to say that there were a few hedgies that decided to sell off their full holdings in the third quarter. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dropped the biggest stake of the 750 funds followed by Insider Monkey, worth an estimated $2.4 million in stock. Philippe Laffont’s fund, Coatue Management, also dumped its stock, about $0.8 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Fresh Del Monte Produce Inc (NYSE:FDP). These stocks are Hailiang Education Group Inc. (NASDAQ:HLG), Rush Enterprises, Inc. (NASDAQ:RUSHA), Ballard Power Systems Inc. (NASDAQ:BLDP), and Edgewell Personal Care Company (NYSE:EPC). This group of stocks’ market values are closest to FDP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HLG | 3 | 8048 | 0 |

| RUSHA | 24 | 83111 | 3 |

| BLDP | 6 | 2731 | 0 |

| EPC | 26 | 233741 | 6 |

| Average | 14.75 | 81908 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $82 million. That figure was $42 million in FDP’s case. Edgewell Personal Care Company (NYSE:EPC) is the most popular stock in this table. On the other hand Hailiang Education Group Inc. (NASDAQ:HLG) is the least popular one with only 3 bullish hedge fund positions. Fresh Del Monte Produce Inc (NYSE:FDP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but beat the market by 4.2 percentage points. A small number of hedge funds were also right about betting on FDP, though not to the same extent, as the stock returned -14.4% during the same time period and outperformed the market.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.